If you’re planning to invest in a short-term rental property for 2023, you’ll also want to invest in the right vacation rental insurance. In most cases, typical homeowner insurance will not cover the vast majority of issues that arise in short-term rentals. Since vacation rentals can be unoccupied for long periods of time and there’s always the possibility of guests causing property damage, insurance companies consider them to be very high risk.

You’ll need to take into account various factors, such as the average length of stay, the rental’s age and condition, and the facilities and amenities you provide when choosing a provider.

Why should I get insurance for my vacation rental?

It’s important to protect your home, its valuables, and your vacation rental business. Landlord insurance policies are designed to cover tenant-occupied properties where standard owner-occupied insurance lacks. For example, homeowners of a vacation property will require a policy covering guest stays, owner vacations, and unoccupancy.

Unfortunately, large OTAs, such as Airbnb, Vrbo, and Booking.com, often have issues with unwanted parties and damages, leaving hosts wary of renting out their vacation homes to large groups. Imagine the feeling of finding out your home and livelihood have been affected by theft or vandalism.

To make the most out of your short-term rental business, you’ll want to ensure that you’re not liable for the cost of repair or replacement.

As there is no one-size-fits-all policy, we compare three of the best insurance companies for vacation rental owners to help you decide which one best suits your business needs.

The best insurance companies for vacation homes

Safely

Safely is a U.S.-based provider of short-term rental insurance specializing in on-site incidents, property valuables, structural property damage, and personal injury, whether it’s to the homeowner, the property manager, or guests.

What does Safely offer?

$1,000,000 in coverage

Costing guests as little as just $8 a night, hosts are protected by up to one million dollars for home damage and bodily injury to guests. All property managers have to do is simply add the guest-paid insurance fee to their listing. Moreover, Safely‘s short-term rental insurance policy covers up to $10,000 in damage or theft to valuables.

Intelligent guest screening

Using innovative technology, hosts have access to a rigorous guest-screening system that identifies problem guests before they even book their stay. Safely only requires the name, date of birth, and address to perform background checks on guests as scans various databases, such as criminal records, credit history, and even a list of previous problem guests. Should any red flag be raised, you can cancel their booking without any legal or financial repercussions.

Quick and simple claims

On the rare occasion that you need to make a claim, hosts have 60 days to gather all the necessary information and evidence for their claim. Furthermore, it only takes 5 minutes to submit a claim, and hosts can expect to be paid within 24 hours for damages less than $1,000. 98% of all claims made through Safely are paid within 4-5 days.

Countries

Safely only covers properties located in the U.S. or in U.S. territories; however, the homeowner does not need to be a U.S. citizen or reside in the U.S.

Pricing

There isn’t a standard starting price with Safely. Instead, hosts receive a customized quote based on the number of days they want to be insured for, the number of properties, their estimated occupancy, and the deductible.

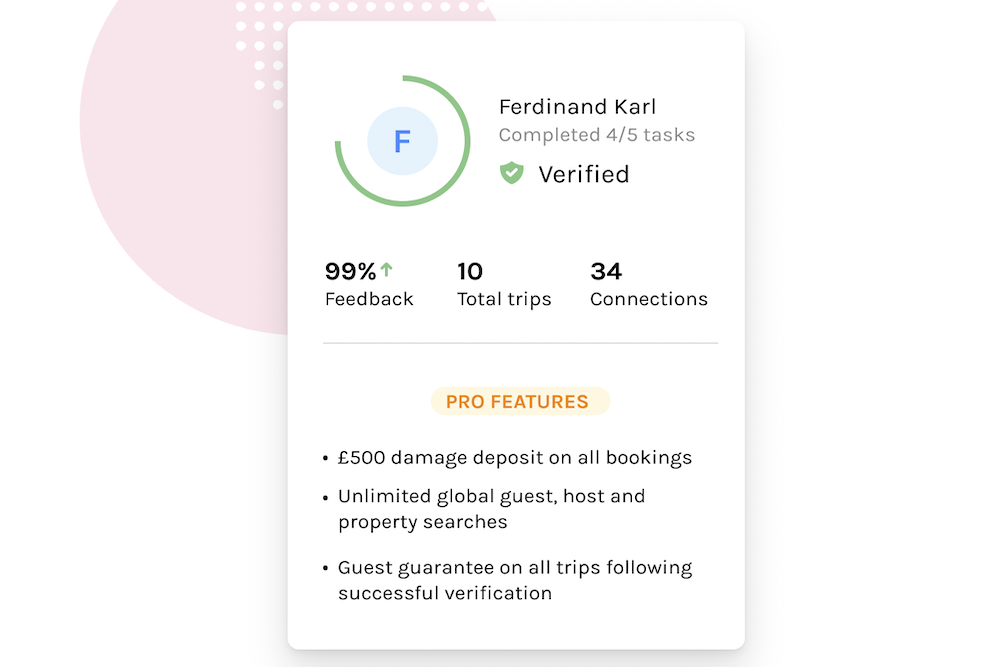

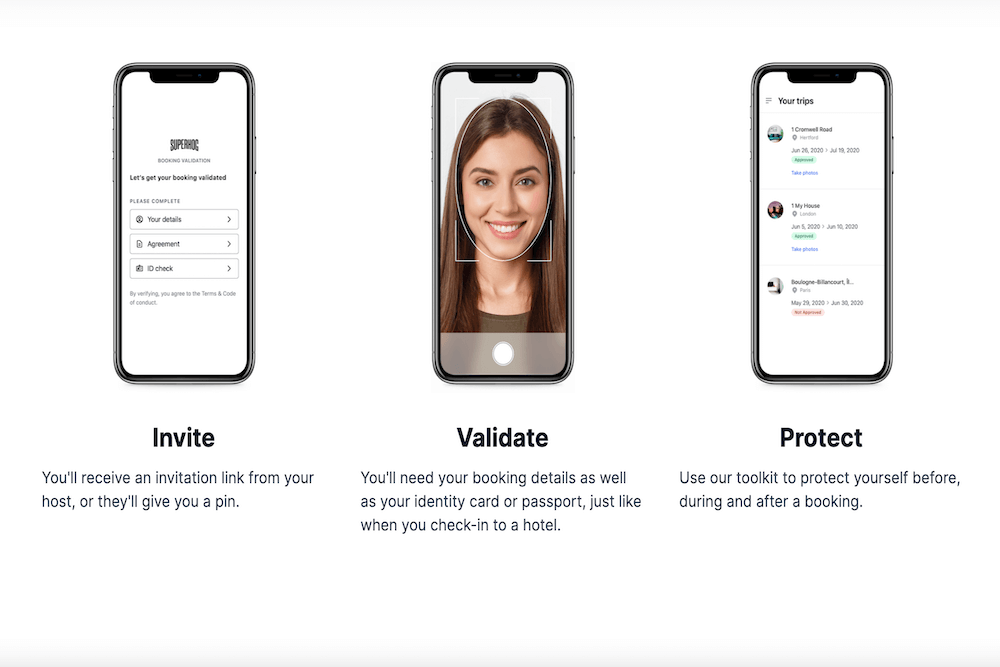

Know Your Guest by SUPERHOG

Know Your Guest is an all-in-one risk management platform providing intelligent guest screening and damage protection for short-term rentals, that can be implemented across all booking channels. They specialize in mitigating the risks associated with short-term rental bookings, providing innovative biometric technology, comprehensive database checks, and facilitating damage waivers and damage deposits for property managers and hosts. Hosts will know their guest is who they say they are.

What does Know Your Guest offer?

Damage protection

$5,000,000 in guest-related damage protection for every Know Your Guest verified booking.

Damage waivers and deposits

One of their stand-out features is choosing whether you’d like to implement a damage waiver or deposit, allowing hosts to take control of covering small incidents of guest damages quickly and efficiently.

Intelligent guest screening

Comprehensive technology that allows you to screen guests before they enter your property: preventing parties, criminal damage and avoiding fraudulent bookings and credit card fraud.

Countries

Know Your Guest is available around the world with just a few restrictions depending on global circumstances. For more information, you can check out their Host Guarantee.

Pricing

The most basic subscription plan, which still includes I.D. verification and database searching, begins at just $3 a month per listing. The advanced plan starts at $5 per month per listing and comes with further financial checks and address verification.

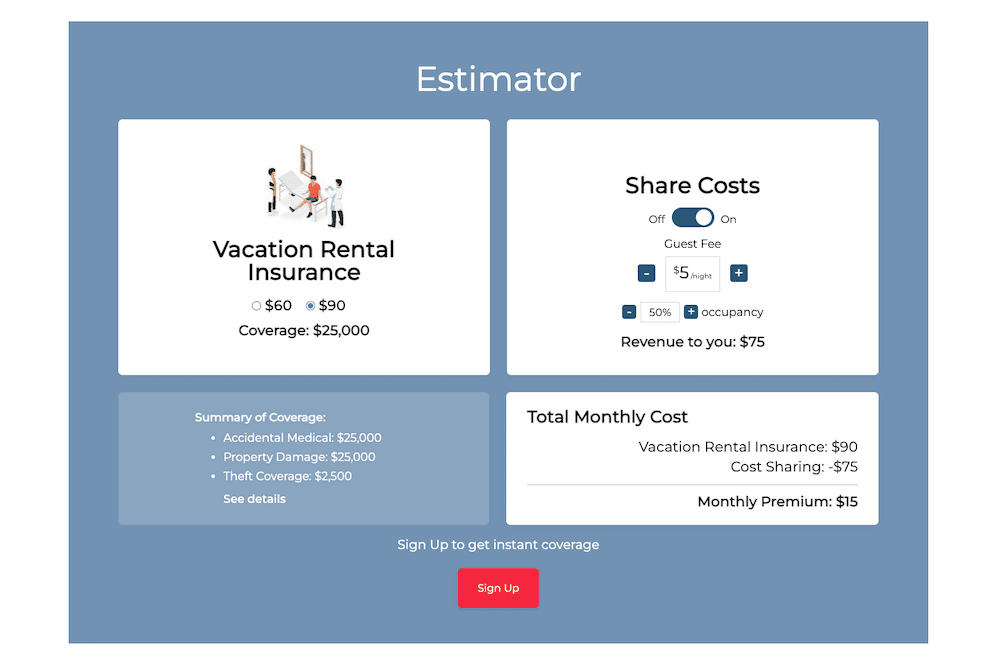

InsuraGuest

Covering guest injuries, property damage, and theft, InsuraGuest provides you and your guests with all the coverage you need to protect yourself and your property. As a Lodgify integration, hosts can insure their vacation rentals by choosing the plan they want and then deciding to either pay the premium themselves or share the cost with their guests.

What does InsuraGuest offer?

$25,000 damage protection

One of the cheapest vacation rental insurance policies around, InsuraGuest offers exceptional coverage for damaged or stolen items. Hosts are covered up to $25,000 if valuables or the property has been damaged, and the same amount against accidental medical incidents on your property for your guests.

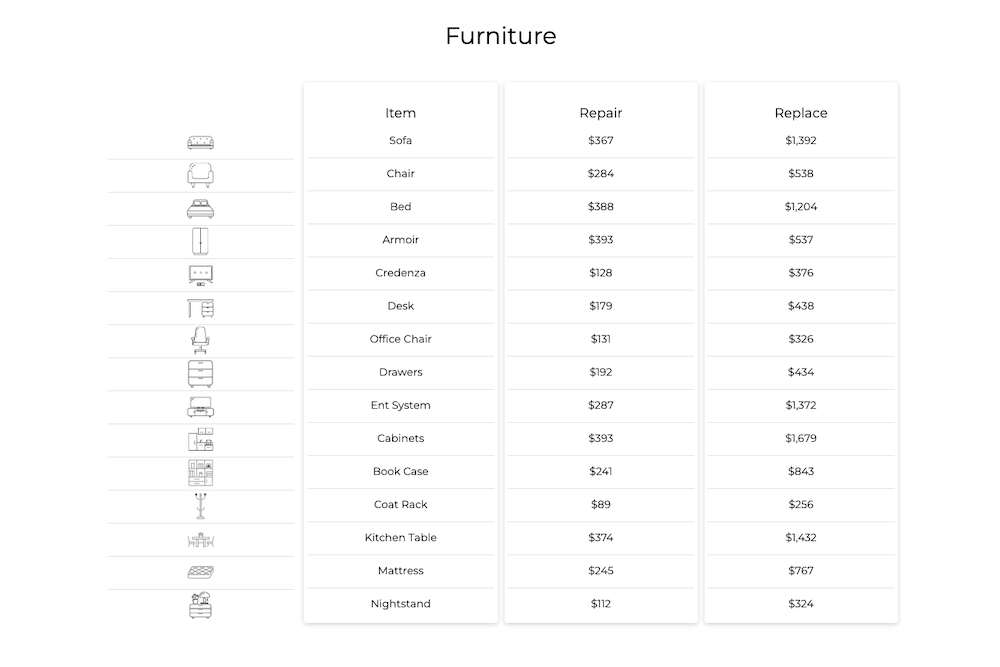

Guaranteed coverage

Moreover, InsuraGuest has a predefined list of typical household items displaying the exact amount you are covered for if you have to repair or replace an item. What makes this Lodgify integration even more appealing is that hosts can choose to share the insurance cost with their guests by adding an insurance fee to their bookings.

No commitment

Unlike other vacation rental insurance companies, hosts don’t have to commit to a certain period of time. Instead, they can simply turn their coverage on and off whenever they want and only pay when it’s in use. Payouts are made within 72 hours if a claim needs to be filed.

Countries

InsuraGuest is only available for properties located in the U.S. Although, the homeowner can reside in any country.

Pricing

Monthly subscriptions start at $60, with the most expensive costing $90, which works out at just $3 a day. There is also an option for hosts to share the cost with the guest, meaning your coverage is paid for by whoever makes the booking.

Doesn’t my AirCover provide adequate protection?

As part of their 2022 Winter Update, Airbnb introduced some new features to their own-brand insurance policy, which is added free to every booking. Hosts have access to guest identity verification, the latest reservation screening technology, and up to $3 million in damage protection; however, is that enough?

While the latest AirCover updates are a welcome boost for hosts, even Airbnb themselves say that host damage protection isn’t an insurance policy and that vacation rental owners should look into additional personal insurance for any property damage caused by guests. There are several key exceptions and exclusions that Airbnb hosts should be aware of.

What about Vrbo’s $1M Liability Insurance?

All hosts and property managers are entitled to free liability protection of up to $1 million, provided that the booking was processed through Vrbo. This vacation rental insurance protects hosts from accidents involving third-party bodily injury or third-party property damage. For example, if a guest were to injure themselves while staying at your property, you would be protected from their medical costs if they try to sue you.

This policy, however, fails to protect hosts from damaged or stolen items on, and including, their property. Instead, Vrbo recommends combining their coverage with an additional vacation rental insurance policy to enhance your protection.

Which is the best short-term rental insurance?

As the vacation rental industry continues to grow, more and more insurance packages are becoming available for short-term rental owners. Unfortunately, there’s no package that suits every vacation rental business. Therefore, when deciding which is the best short-term rental insurance, it really depends on your needs as a host.

Consider how many properties you own, how many nights you rent them out for, which country your vacation rental is in, and what exactly you want to be protected against. The three mentioned in this article all offer exceptional coverage at affordable rates while specializing in different areas of vacation rental security.

Additionally, they all integrate with Lodgify, meaning if you’re a Lodgify customer, you can seamlessly add either package to your account. You can try our bookings management system completely free with this 7-day free trial.