Before anyone had even heard of COVID-19, credit cards were already taking the spotlight as the preferred payment method. According to Forrester, US eCommerce purchases using credit and debit cards totaled $3.6 trillion in 2017, with 60% of these sales taking place directly on PCs, cell phones, or tablets. In addition, Worldpay recently published a report on Global payments which suggests that the most popular payment methods in the future will be eWallets (46% by 2021), credit cards, and bank transfers.

While there are a lot of payment methods out there, it’s clear that many travelers rely on using their credit and debit cards to process their online purchases. Now more than ever, it’s very important for any online retailer – especially vacation rentals – to adjust their business payments to what guests expect from them.

Advantages of accepting credit cards:

1. Contactless payments and COVID-19

Although the popularity of contactless payments has been on the rise for several years now, the COVID-19 outbreak has emphasized its importance even further. In fact, from Apple Pay to tap-and-go credit cards, over half of the U.S. population now uses a form of contactless payment.

During a pandemic, not only does this payment habit drastically reduce the need for handling cash, but it also allows people to pay by card without having to put in their pin. Because the contactless process is much faster than previous payment types, it also shortens the amount of time that people are standing in line or interacting with a host.

As a vacation rental owner, you’re likely to get a flow of guests coming in and out of your property. Because of the current situation, you should encourage your guests to pay online. By accepting online credit card payments on your vacation rental website, you’ll help reduce the transmission of the virus by avoiding interaction. Doing so will protect you, your guests, and your community as a whole. You can even take it a step further by allowing guests to do self check-ins.

President of the U.S. issuers at Mastercard told CNBC Select that “what we’re really seeing during this crisis period is a consumer behavioral shift to leveraging contactless products”. In other words, this new tendency is here to stay and your potential customers, who are likely to prefer paying online with their credit cards, will expect to see this feature.

2. Preferred payment method by guests

Almost half (42%) of global online shoppers prefer to pay by credit card. When we add this to the 28% who prefer to pay by debit card, that makes a huge majority. Being able to pay by credit card is a great way for guests to keep their payments safe due to the consumer protections in place that defend them against fraud or unforeseen cancellations.

According to senior travel expert Nancy Parode, “while senior and Baby Boomer travelers are accustomed to writing checks, younger renters are not. They use credit cards, debit cards, and smartphones when they want to purchase something or make a deposit. Vacation rental owners who accept credit cards are more likely to appeal to younger renters – in other words, to the customers of the future”.

3. It’s the most secure and reliable payment method

Some vacation rental owners don’t mind waiting 10 days to receive their check or the bank transfer because they believe it’s the safest way to collect payments. In reality, however, credit card payments are one of the most secure payment methods available for online vacation rental businesses.

Credit cards offer sophisticated internet solutions to prevent fraud:

- LinkPoint Secure Payment Gateway: processes payments in real-time using a technology called Secure Sockets Layer (SSL) which encrypts all confidential information during transactions so it can’t be seen by anyone.

- Address Verification Service: this can help you detect suspicious transactions because it compares numerical information of your customers with records owned by banks who have issued those cards.

- Card Validation Code: you know how credit cards have CVC or CVV codes in the back? These numbers help you determine whether your guests possess legitimate cards.

What’s more, it’s just as safe and reliable for guests! Credit cards offer strong fraud protection and it’s easy to get charges reversed. Under the US Truth in Lending Act, credit card holders are liable for unauthorized use of the card only up to $50. Nancy Parode tells us that “credit card companies will allow cardholders to dispute fraudulent charges, which gives potential guests an added sense of security as they decide where to stay. Vacation rental owners who accept credit cards send a positive message to guests.”

4. It’s convenient for guests and vacation rental owners

It’s easy for guests to pay for their bookings; they can easily whip out their credit card, type in their details, and voilà! They can forget about writing checks, going to the bank, waiting at the post office and all those other things that can delay the booking process.

As for vacation rental owners, credit card payments will allow you to:

- Enable instant bookings, easily approve your guests and confirm bookings

- Easily issue refunds in case of cancellations

- Automatically send email payment receipts to guarantee that the booking has been confirmed

Parode adds, “accepting credit card payments also allows guests to book their preferred vacation rental property early, regardless of whether or not they have saved all the money for their trip. Guests can pay a deposit by credit card many months in advance, knowing their reservation is guaranteed.”

5. It gives credibility to your vacation rental property

There are a lot of articles out there about fake vacation rentals and how to avoid them. Most of them recommend travelers to avoid listings that demand bank transfers or a wire service like Western Union, and to only book through those that accept credit cards directly through services such as Stripe and PayPal.

Therefore, by accepting online payments, you’ll prove to your guests that they can trust you and it will, in turn, increase the credibility of your vacation rental business. Hopefully, that will lead to an increase in booking conversions, too!

6. It improves cash flow

Credit card charges are deposited directly into your bank account. Your business will instantly collect payments, meaning you’ll no longer have to wait days for a check to arrive by post (or have to worry about bounced checks!). Most importantly, you will be able to pay all your own bills on time.

7. It helps you stand out from your competition

You’re in a competitive industry and as everybody is fighting for the same thing, it’s important for your properties to stand out from the crowd. Approximately 62% of vacation rental owners use checks, cash or other lengthy manual payment methods. Be part of the 38% that knows just how important accepting credit card payments is!

8. It’s not as expensive as you think!

The biggest concern vacation rental owners have is that processing credit card payments comes at a cost and you don’t receive 100% of the payment. Luckily, we’re here to tell you that costs aren’t high when you consider the benefits it brings you!

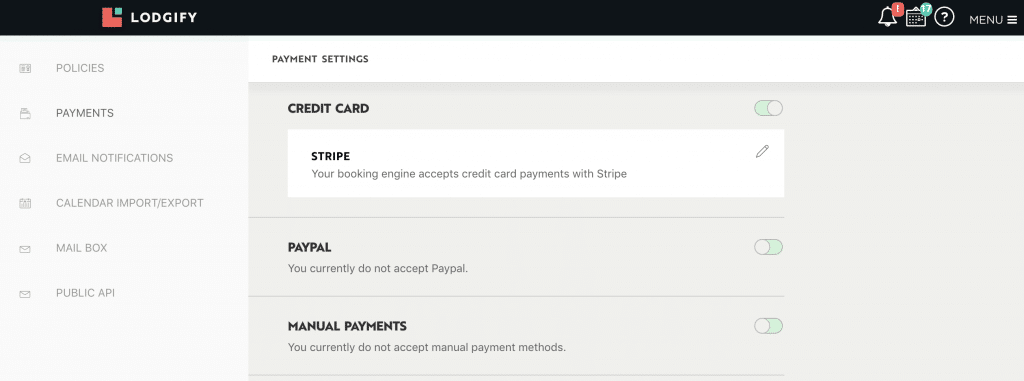

You can easily integrate a service such as Stripe into your existing booking engine. Stripe charges a percentage-based flat rate every time you accept an online payment: 2.9% + $0.30 for US cards and an additional +1% for international cards. Prices do vary depending on your country and region, so make sure you check out their website.

See? It’s not too bad if you think of all the instant bookings that will start coming in. You could even pass the cost impact on to the guest or only use credit cards to accept the reservation deposit, e.g. 50%, and collect the residual amount in cash. That way you will split the credit card costs in half.

9. It’s easy to set up!

It’s not as difficult as you may think and anyone can set it up! Just start with signing up for a free Paypal or Stripe account and you’ll be able to connect it to your Lodgify account.

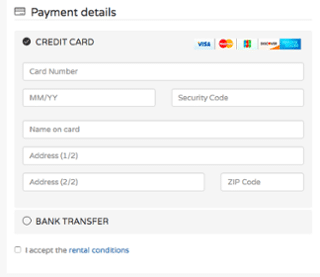

Lodgify allows you to accept credit card payments through our secure booking system. It’ll guide your guests through a simple booking process and you’ll automatically collect all the payments.

You can set it up with our booking engine guide here or if you prefer, you can speak to a Lodgify support expert.

Easily integrate credit card gateways like Stripe or Paypal to your Lodgify account and start accepting Visa, MasterCard, American Express and others at no extra cost. Try it out with our free trial!