Embarking on the financial journey within the vacation rental industry comes with its own set of challenges. Property managers often find themselves grappling with manual bookkeeping, expense allocations, trust accounting, and precise payout management. These tasks, though crucial, can consume valuable time, are prone to errors, and divert attention from core business operations.

To take this burden off your shoulders, Lodgify decided to partner up with Clearing, a comprehensive financial management software.

What is Clearing?

Meet Clearing, the game-changer in trust accounting and automated bookkeeping designed exclusively for Short-Term Rental operators. Clearing is not just a tool; it’s a complete solution empowering property managers to revolutionize their financial workflows. With Clearing, the process of closing books accelerates, as it seamlessly handles cash flow tracking, expense management, owner statement generation, bookkeeping, trust accounting, and streamlined payments to homeowners and vendors.

What advantages does Clearing offer ?

From the hassle-free automation of bookkeeping tasks to the effortless organization of funds through trust accounting: Clearing ensures a user-friendly and efficient experience for property managers. Let’s explore how these features pave the way for a future of streamlined financial management in the realm of short-term rentals.

Automated Bookkeeping

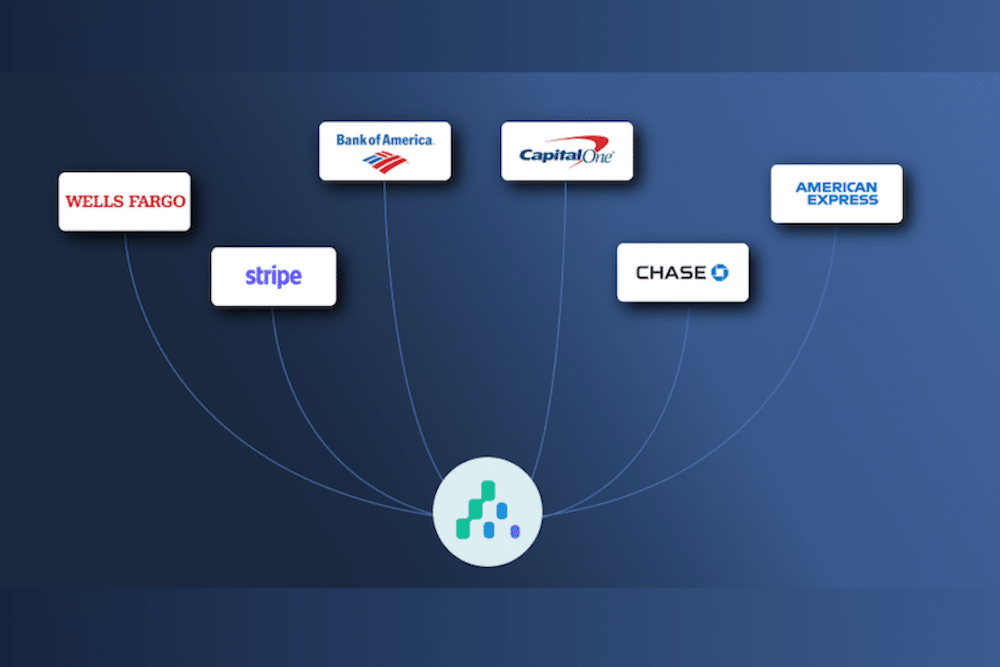

Clearing easily manages the tedious tasks of categorizing and allocating transactions, saving you from manual effort. Connect all your financial data sources in one platform, eliminating the need for cumbersome spreadsheets. Automated reconciliation streamlines the matching of booking details with bank deposits, offering pre-categorized lists for each payout, be it for cleaning fees, host fees, taxes, and more. Plus, customize rules to put your bookkeeping on autopilot, providing a quicker and more efficient way to close your books. With Clearing, experience a seamless financial management process.

Trust Accounting

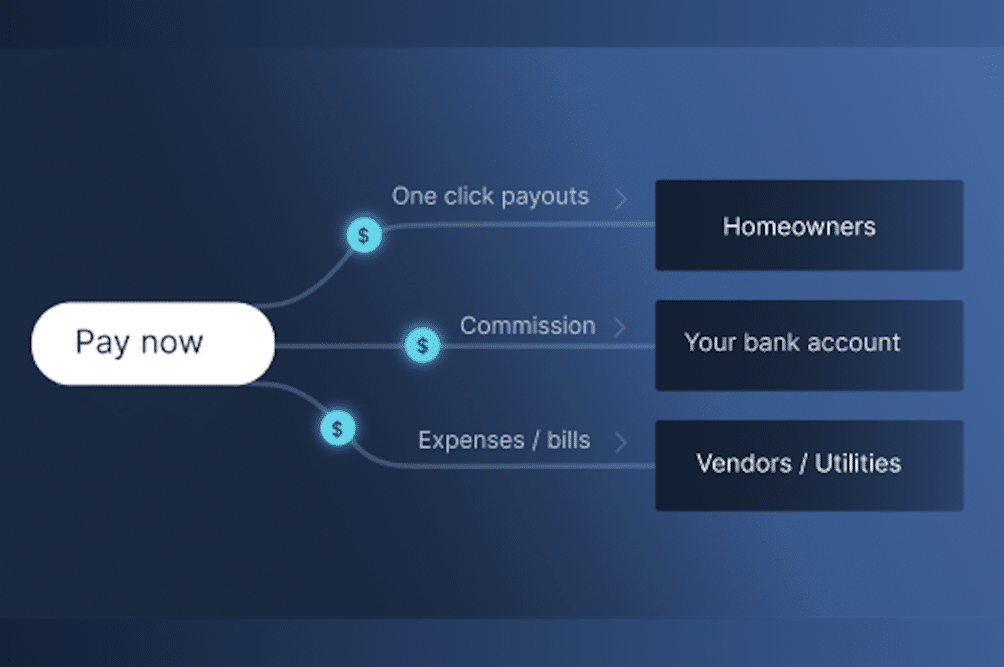

Clearing’s Trust Accounting feature simplifies and automates fund management for property managers. Tailored for short-term rental owners, it enables effortless organization and collection of funds by homeowner or property group. Utilizing zero-balance accounts ensures accurate and automated fund allocation. The software streamlines commission tracking, preventing any mix-up with homeowner payouts. Additionally, Clearing facilitates direct payments to homeowners, bills, and utility companies, providing a user-friendly and efficient solution for short-term rental financial management.

Expense Management

This functionality allows you to track and categorize all your expenses in a unified view. Clearing automates the categorization and allocation of transactions by property, ensuring consistency. Seamlessly split transactions across various listings and add collaborative notes to enhance communication with your accountant. Attach receipts to transactions for a comprehensive record and easily filter transactions based on homeowners, properties, categories, and more.

Reporting

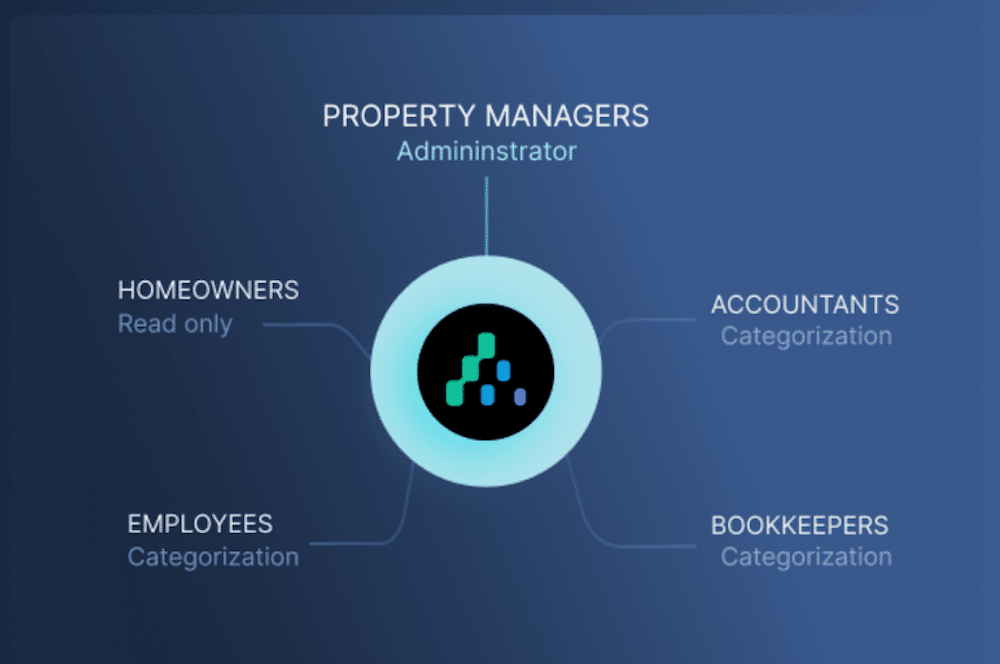

Clearing automates reporting by category and property, offering real-time insights into your cash flow while waving goodbye to manual spreadsheets. Easily filter and compare listing performance for optimized operations. But that’s not all—smoothly generate owner statements, customize them to your liking, and share directly with owners via email or a direct access portal. Further, profit and loss (P&L) statements can be created for the entire business, or individual assets, ensuring your accountant has all the information they need. Collaborate efficiently by inviting your accountant and team, as Clearing transforms property management reporting into a seamless experience.

How Much Does Clearing Cost?

Discover Clearing’s flexible pricing plans, starting at only $27.50 USD per month for 1 property, with a one time implementation fee of $99.00. Benefit from a 10% discount when you opt for an annual subscription. For detailed pricing information, visit Clearing’s Pricing page.

How to Integrate with Clearing?

If you are new to Clearing, book a free demo here. Experience a white-glove onboarding process tailored to your needs. During the 1-3 sessions, the onboarding specialists will help you to connect your Lodgify account with Clearing directly.

If you are already a customer, follow these steps to start your journey:

1. Login and click on the setting tab at the bottom of the page, then click into integrations.

2. Click on connect to PMS and select Lodgify.

3. Paste your API key and click connect.

The synergy between Clearing and Lodgify is poised to be the cornerstone of elevated financial management. Don’t miss the chance to automate your bookkeeping, simplify trust accounting, and enhance your overall financial visibility. Request a demo now and embrace a future free from the intricacies of financial complexities.

Note: Virtual bank accounts and ACH payments are currently only available in the USA – however, full bookkeeping and owner statements capabilities are available in both the USA and Canada. More countries are coming soon! Stay tuned for more information.