Your time, money, and energy are of the essence as a vacation rental owner or property manager. When you manage a vacation rental business, many small expenses come up. Pair that with fixed costs like salaries, cleaning fees, and trash services, and you’ve got yourself an accounting nightmare!

Your time is best spent tending to your host duties, not worrying about who to pay next.

Thankfully, having a short-term rental expense spreadsheet will make running your business a lot easier, enabling you to easily keep track of your income and expenses. But don’t take our word for it—let’s took a look at why you need a short-term rental spreadsheet and key metrics to include to help you monitor your finances. Then you can get started with our Excel template, free of charge to download!

Don’t see the form to download the expense tracking spreadsheet? Click here.

Why do you need a short-term rental expense spreadsheet?

The primary goal of a short-term rental Excel spreadsheet is to make your financial management as easy and painless as possible. When you use a vacation rental income and expense worksheet, you minimize manual accounting work. Adding this spreadsheet to your toolkit just makes sense.

Save time and effort

By using a short-term rental accounting spreadsheet that’s already programmed to meet your vacation rental needs, you avoid having to manually calculate your finances every month. Instead of starting from scratch each billing cycle, you just have to pop in your monthly expenses and earnings and you’re done! No more time wasted doing the same tasks over and over.

What’s more, when it comes to filing your taxes, you’ll already have your numbers available in one handy short-term rental spreadsheet, saving you time and stress.

Looking to go a little deeper? Consider using Lodgify’s accounting tools. These helpful tools calculate how much your business is earning and spending, sum up your total revenue from all your listings, and let you filter for booking periods. You can also keep track of incoming and outgoing payments. These tools eliminate hours of administrative work and give you a much deeper analysis of your finances.

Improve staff management

As a vacation rental owner, you are well aware of the many steps that go into room presentation, upkeep during the stay, and cleanup after your guests leave. With each of these steps comes an array of fees and services. To keep the business running smoothly, payments should be handled swiftly and on time. In the event of late payments or inconsistencies, you can aggravate staff and consequently receive subpar service, and your guests deserve nothing but the best!

When you implement a system that consistently keeps payments to your staff members on time, you deliver better service to your guests. Guest satisfaction equals more bookings, which is more money in your pocket.

Don’t overlook any expenses

The little expenses that come with managing a property, like replacing a door handle or deep cleaning the carpets, can really add up. Sometimes, these small costs are missed, leading to unknowns in your budget. Keep your customers, employees, and wallet happy by tracking them in our worksheet.

Bonus tip: Put these expenses in our vacation rental income calculator to estimate how much you should be making from your property.

Understand your vacation rental’s performance

You might have a feel for how well your business is doing. But without actual data, you’ll never really know. Eliminate the guesswork by using a vacation rental expense spreadsheet. You can see where the bulk of your expenses are coming from and decide if you want to cut back on any purchases.

By tracking key data in your short-term rental analysis spreadsheet, you can also figure out what months perform better, what type of guests you appeal to, and what your projected revenue will be. Once you have the numbers, you can identify areas for improvement and, if necessary, reinvestment.

An expense tracking spreadsheet can help you to understand your average rate. However, if you want to price your properties to maximize profits, we encourage you to use our dynamic pricing tool. Lodgify Dynamic Pricing uses an algorithm that factors in more than 40 attributes, market conditions, and local trends to automatically optimize and update your rates, keeping you competitive year-round.

Once you have your prices perfectly adjusted to meet your needs and demand, you can pop the numbers into your expense report and see just how well your vacation rental business is doing.

What does the short-term rental expense spreadsheet cover?

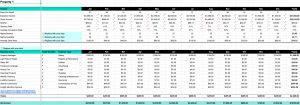

Our short-term rental expense spreadsheet allows you to write in all the expenses and purchases you’ve made for your vacation rental on a monthly and yearly basis. The template already includes some basic costs, such as cleaning products and property management tools. From there, you can customize it to meet your needs. For example, if one of your properties has a pool, you can put in the associated maintenance fees to keep track of how much the upkeep is costing you.

Beyond expenses, you can also evaluate your income and income expectations. You can add in the gross income for each month and compare that to your expected earnings. You’ll also get a rough estimate of your average nightly rate for each month.

Lastly, you’ll be able to contrast your expenses to your earnings to better understand profit margins and what percentage of your earnings are going to expenses and fees.

Here’s a preview of our vacation rental property expenses spreadsheet template to give you a better idea:

Ready to dive in? Scroll to the bottom of the page to download our free template!

Essential metrics to include

Now let’s take a closer look at specific metrics you’ll want to include in your expense tracking spreadsheet:

- Gross revenue represents the total income generated monthly, encompassing nightly rates and additional services like airport pickup or guided tours.

- Occupancy rate indicates if nightly rates are appropriately priced, highlighting the need for rate adjustments or added amenities if it’s below average. You can calculate occupancy rate by dividing the nights rented by available nights.

- Average daily rate (ADR) reveals your average income per night. Calculate it by dividing gross revenue by the number of nights booked.

- Revenue per available room (RevPAR) highlights the revenue generated per room regardless of occupancy. Divide gross revenue by the total available nights to find RevPAR.

- Average length of stay (ALOS) is calculated by dividing the total booked nights by unique bookings, providing insight into guest stay durations.

- Expenses encompass various costs including utilities, supplies, cleaning services, and booking and management fees.

- Booking fees imposed by vacation rental platforms like Airbnb or Vrbo generally range from 3% to 8% of the total guest charge.

- Management fees vary based on factors like property size and services provided, typically ranging from 12% to 50% of gross revenue.

- Net operating income (NOI) gives you an idea of your property’s profitability. To arrive at this figure, deduct your expenses from your gross revenue, excluding mortgage payments and capital expenses.

- Projected revenue offers insight into performance versus budget. It helps you compare actual and estimated revenue based on various metrics such as gross revenue, ADR, and RevPAR.

- Cash flow is the result of subtracting all expenses, including mortgage payments, from gross revenue, reflecting the actual income generated.

Download our free short-term rental expense spreadsheet

You never want to navigate the vacation rental business blindly. Having markers for expenses and earnings helps you understand where your money is going and what you might need to change to maximize your bookings and income. So, download our short-term rental calculator Excel template now to start keeping better tabs on your finances.

And remember: if you’re looking for more in-depth financial analysis, you can try Lodgify’s accounting tools for free. Start your 7-day free trial today!

Don’t see the form to download the expense tracking spreadsheet? Click here.