If you manage a vacation rental business or want to invest in a short-term rental, it’s crucial to understand how and when to pay your short-term rental taxes. As the industry continues to grow, more and more rules and regulations are being implemented by the authorities. One of the most significant ones is undoubtedly the legal requirement for hosts to pay lodging taxes for their business.

However, it can be difficult for many property managers to understand what taxes need to be collected, when to collect them, and how to file them. There are many factors to consider during the process, including the location of your property and how many days you rent your house out for.

It’s important for you as a host, and the vacation rental industry in general, that short-term rental businesses are tax compliant. Firstly, there can be large fines and penalties for hosts who fail to file their taxes correctly. This can include being suspended from OTAs like Airbnb, Vrbo, and Booking.com. Secondly, the authorities are likely to implement more favorable jurisdictions and regulations for vacation rentals if they can be tax compliant.

So, how do you make sure your short-term rental business is tax compliant?

On Wednesday, February 15, Alberto Fernández, SEO and Content Lead at Lodgify, was joined by Justin Stasio, Sr. Onboarding Specialist at Avalara, to discuss what U.S. hosts need to know about short-term rental taxes. Avalara is a software company that specializes in tax compliance and provides automated solutions for short-term rentals.

This article aims to offer those who attended and those who missed the webinar the opportunity to view it at their convenience. You will find the webinar recording, a breakdown of all the topics discussed, some valuable tips, and a selection of the best questions from the Q&A section.

Webinar recording

Webinar recap

The webinar, which had over 1,200 registered attendees, kicked-off with Alberto’s presentation about Lodgify’s main and latest features, such as the updated mobile app, the recent integration with Google Vacation Rentals, and the newest additions to Lodgify’s third-party apps marketplace.

Justin Stasio was then invited to begin his insightful and detailed presentation on short-term rental tax basics, which covered the following:

- What you need to know about lodging tax

- Five steps to achieving lodging tax compliance

- Lodging tax & vacation rental marketplaces

- How does Avalara MyLodgeTax fit in?

- Q&A

What you need to know about lodging tax

Lodging tax is a general term for the combination of state and local taxes levied on the short-term rental of a room or property.

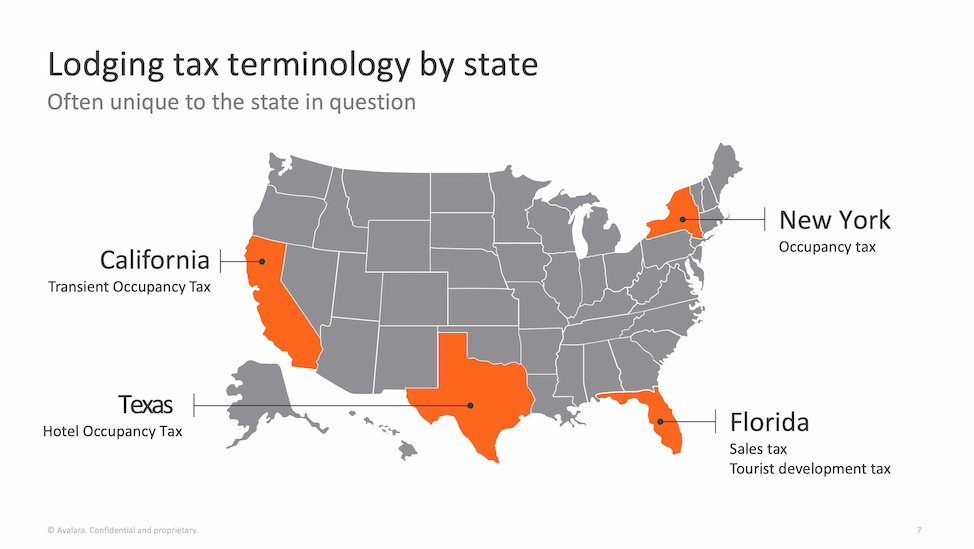

Justin defined the concept of lodging tax before discussing the importance of understanding the terminology associated with it. He then highlighted how some states refer to these taxes by other names and how the legal rental period of each state differs.

Five steps to achieving lodging tax compliance

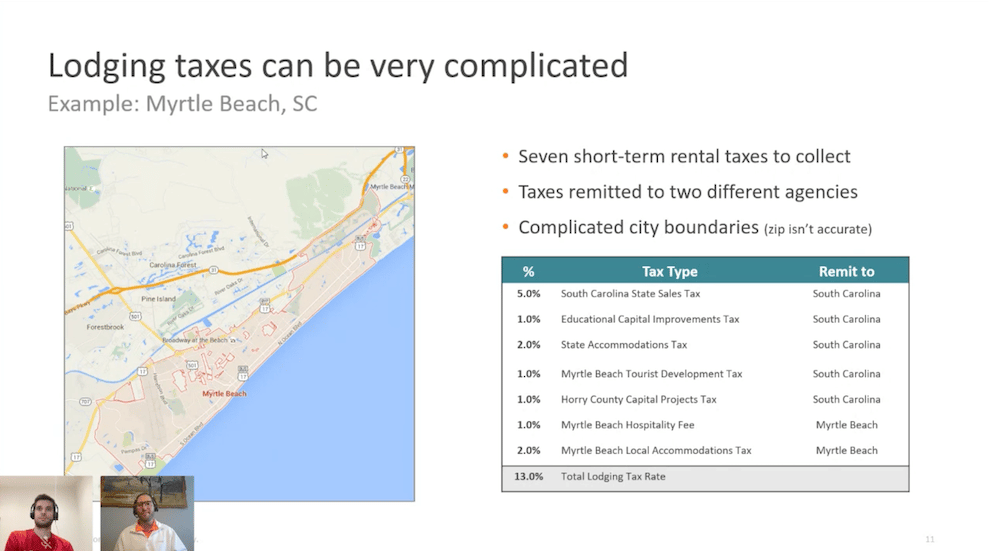

After analyzing the taxes a vacation home in Myrtle Beach would incur as an example, Justin talked us through some common lodging tax misconceptions and the impact these taxes have on the industry and the local community. He then shared expert advice when discussing the five steps hosts should take to ensure lodging tax compliance. These are:

- Research lodging tax requirements

- State and local registration and licensing

- Collecting lodging tax from guests

- Filing and remitting state and local lodging taxes

- Manage filing notices and delinquencies

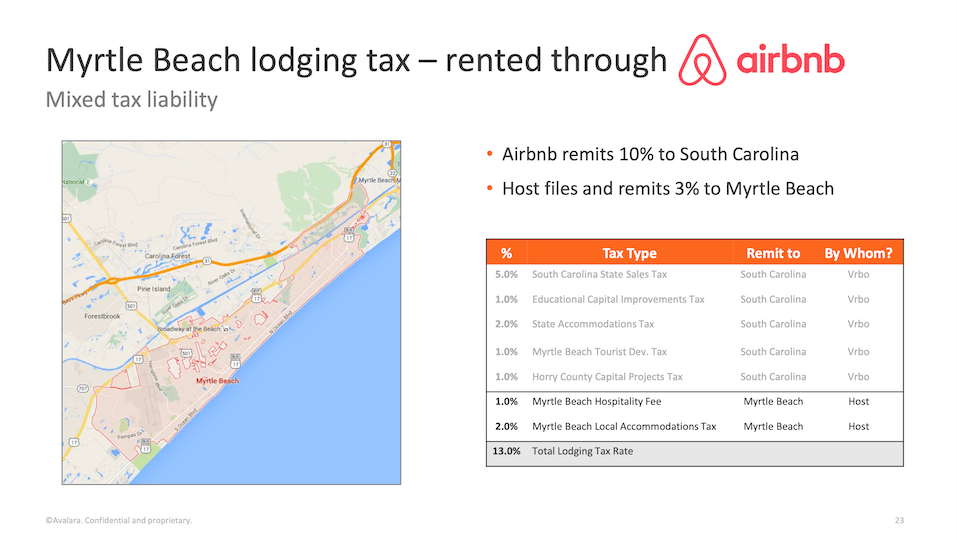

Lodging tax & vacation rental marketplaces

One of the most complicated aspects of collecting lodging tax is knowing how much your vacation rental marketplace remits on your behalf. Justin explained how the rate differs depending on the OTA your property is booked through. For example, Airbnb may remit a higher or lower percentage of tax compared to another OTA, emphasizing the importance of researching the differences between each marketplace.

How does Avalara MyLodgeTax fit in?

In this section, Justin showcased the benefits of MyLodgeTax by Avalara, which is described as “the only automated tax solution for short-term rentals” on its website. MyLodgeTax can identify and apply for the tax accounts, licenses, and registrations that you and your property need, as well as determine your tax rate and remit all your lodging taxes.

Q&A session

Question: If my entity is registered in the state where I live, but my short-term rental is in another state, what do I have to do to pay my lodging taxes?

Justin: This goes to a concept called Foreign Entity Registration. This is an application that hosts must complete in order to put their business entity on the public record in the state where their property is located.

When you establish the licenses and the registrations for your vacation rental, those government agencies are going to reference the public record to ensure your business is registered with the Secretary of State. If your entity is not registered, they’re not going to be able to process a license.

Question: What about expenses made around bookings? Are cleaning fees, etc., subject to tax?

Justin: Fees like cleaning and pool heating fees – anything included in the short-term transaction – are taxable. We itemize products and services that the guest will receive in their reservation; however, the lodging tax amount is applied to the total amount paid by the guest or the sum of all mandatory fees.

Question: Are there any tax advantages in setting up a short-term rental business as an LLC?

Justin: I won’t be able to explain any tax advantages as those are related to income taxes; however, when we look at the lodging tax application, there really is no difference. Lodging taxes can be filed using a business entity, like an LLC, or as a sole proprietorship.

Question: Can an owner deduct expenses for costs associated with having to stay somewhere else while their personal home is booked?

Justin: This goes back to the concept of separating income taxes from lodging taxes. Anything related to deductions and expenses is going to apply to income tax, so you should talk to your accountant about your situation.

Question: What does the process of MyLodgeTax helping hosts through the registration look like?

Justin: MyLodgeTax takes approximately one month to establish the various registrations and licenses that apply to each short-term rental. For example, if a property subscribes to the MyLodgeTax service in March, you’ll be given an April start date.

We try to keep the registration process as hands-off as possible. That means that MyLodgeTax will identify the appropriate registrations, licenses, and applications and then complete and submit those on our users’ behalf.

However, there may be instances in certain jurisdictions that require the owner or property manager’s involvement. There are certain licenses where MyLodgeTax is simply unable to satisfy all of those application requirements. In these cases, our licensing department will identify and send our users instructions on what additional action is required to set up those licenses.

Question: Could you please clarify that if the fee is refundable, it is not taxable?

Justin: That’s correct. If you are including refundable fees in the lodging tax transaction, then you would not include that amount of revenue in the amount that we apply taxes. So, anything refundable does not get included in the taxable amount.

Question: How and where can I find the tax entities involved with my property?

Justin: One of the best ways to approach our compliance strategy is by understanding how we need to conduct our research. You need to segregate the various levels of jurisdiction – the state, the county, and the city. Depending on where that property is located, those levels of jurisdiction might be controlled by different agencies.

State taxes are generally controlled by the state Department of Revenue, so contact them for any state requirements and ask them if there are any other state agencies that would apply to the tax or registration.

One of the best examples of this is Florida, the biggest vacation rental market in the United States. There are two state agencies that require registration; the Secretary of State and the Florida Department of Business and Professional Regulation.

Then work your way down the line, contact your county tax collector and call your city hall, reaching out to each level of jurisdiction.

Question: I am a California resident, but my short-term rental is in Miami, Florida. I run my business as a sole proprietorship. I only rented through Airbnb, and they handled all the state taxes. Do I need to file any additional taxes with the state of Florida?

Justin: Some marketplaces (such as Vrbo and AirBnB) have agreements with jurisdictions to automatically collect and remit lodging taxes for reservations made on their platforms. Taxes remitted by online marketplaces do not reconcile or give credit to individual hosts/properties/tax accounts. Hosts still are responsible for establishing all of the appropriate registrations to operate a short-term rental and filing the appropriate business tax returns, accommodating taxes paid by online marketplaces.

Question: I only have one rental and another full-time job. I was looking into making an LLC to keep the STR separate (and also protect my assets). What are the tax implications currently as a sole proprietor vs converting to an LLC? Can I use the same write-offs to decrease my personal taxable income?

Justin: Whether you operate your STR as an LLC or sole proprietor has no bearing on the amount of state, county, or city lodging taxes you are obligated to collect and remit. Write-offs and deductions are related to your income tax returns, and Avalara recommends you reach out to a CPA for advice on how to best move forward here.

How to contact our speaker

If you have any more questions or would like more information about MyLodgeTax, you can contact the Avalara agents by phone or by email at mylodgetax.com.

Although lodging tax is a complicated concept, we want hosts to feel empowered and confident in taking their vacation rental business to the next level. We hope this webinar provided insight into short-term rental taxes and the necessary steps to become licensed, registered, and tax compliant.

To learn more about how Lodgify can help your vacation rental business, sign up for our 7-day free trial or book a demo call here: https://use.lodgify.com/start

If you would like to download the presentation, please fill in the form below!