Airbnb & Short Term Rental Laws and Restrictions in Florida (2024)

Last updated: March 2024

Are you ready to join the ever-expanding market of short-term rentals? Investing in short-term rental properties or transforming your space into one can be a fantastic way to make a little extra income. According to Statista, the potential market volume is slated to top $21.1 billion by 2028.

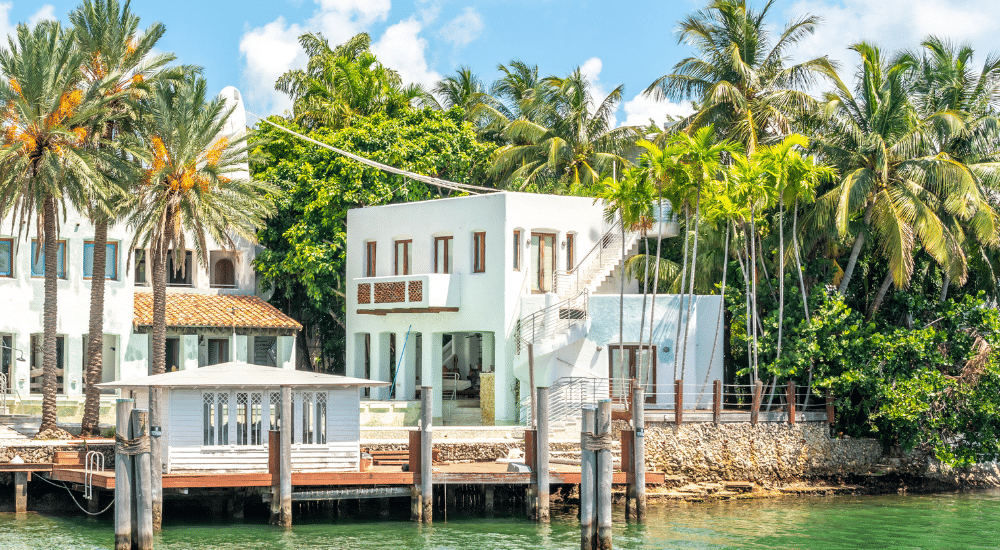

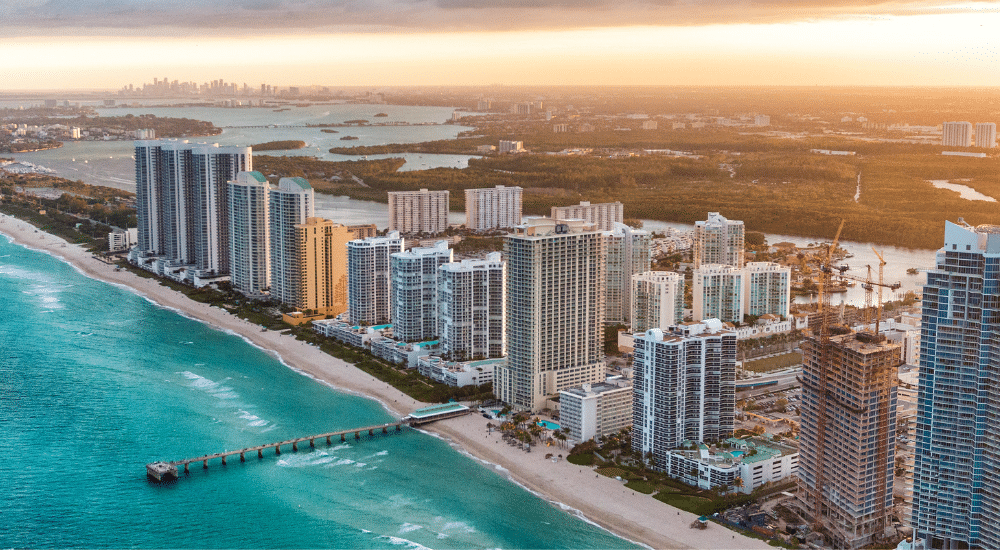

Given the market is still expanding, now is a great time to get your short-term rental business up and running, especially if you live in a state like Florida, where major tourist attractions and world-class beaches draw record crowds each year. VisitFLORIDA logged more than 135 million visitors to Florida in 2023 alone.

Before you start, though, you’ll want to familiarize yourself with Florida short-term rental laws that could impact how you manage your property or run your business. This guide will help you understand everything related to short-term rental laws in Florida while answering common questions like, “Do I need a permit for a short-term rental in Florida?” and “Are there any Airbnb restrictions in Florida?”

Scroll through for industry insights for some of the Sunshine State’s most popular locales so that you can rest assured that you’ve covered your short-term rental business bases.

What is considered a short-term rental in Florida?

Let’s kick this guide off with a question most new vacation rental owners (or hopefuls) have: What is considered a short-term rental (STR) in the State of Florida?

The basic definition of a short-term rental in Florida, according to the state’s Department of Revenue, is any individual lease agreement that is less than six months in duration. Regardless of the duration, the State requires a 6% State Sales Tax to be collected from these rentals and sent to the Department of Revenue.

According to Chapter 509 of the Florida Statutes, a short-term rental is a housing accommodation rented for stays of 30 days or less, more than three times per year. This definition includes properties advertised or presented as regularly rented to guests.

What’s most important to know is that these ordinances are written in such a way that individual counties and cities are afforded significant leeway in setting their own rules and regulations for STRs. Thanks to this statewide flexibility, the definition of a short-term rental can vary somewhat by jurisdiction.

For example, let’s compare the definitions of short-term rentals between Miami and Fort Lauderdale.

Both define STRs similarly as, using Miami’s phrasing, “any unit or group of units… that is rented to transient occupants more than three (3) times in a calendar year for periods of less than thirty (30) days or one (1 ) calendar month.”

Fort Lauderdale’s ordinance adds to this definition, though, any property that “is advertised or held out to the public as a place regularly rented to transient occupants . . . but that is not a timeshare project.” These might seem like a small difference between the two municipalities, but even these subtleties can have a great impact on someone attempting to launch an STR business.

Another example of this difference between state and local definitions can be seen in the home-share space of the short-term rental market.

According to the State of Florida, in the scenario where an owner is sharing only a portion of their home and can serve as a “host,” the STR definition does not apply. So, from a state perspective, if you want to rent multiple single rooms in your Florida home on Airbnb or another short-term rental site, feel free to know that you skirted past this Florida regulation.

What to know about short-term rental laws in Florida for 2024

While Florida state regulations offer ample room for interpretation and different home-sharing scenarios, many individual cities continue to work towards limiting them. Many municipalities restrict this ability by either capping occupancy or by limiting the districts in the city in which such home-share STRs can operate.

For example, in February 2024, the Florida Senate passed SB280, which stipulates that the maximum number of people allowed to stay overnight in a vacation rental is determined by the number of bedrooms. It’s set at two people per bedroom, with an extra two people permitted in a common area.

However, if each person has at least 50 square feet of space, more than two people can occupy each bedroom. The final count, whichever is greater, includes the additional two people allowed in a common area.

As part of this new bill, though, local governments can now charge a “reasonable fee” to a vacation rental owner to register the property, among other local regulations allowed. So, in short: just because the state regulations permit or deny an action does not mean that the city also will.

The examples shared here aren’t meant to confuse you more. Short-term rental regulations in Florida (and any other state!) are, by nature, somewhat complex—but just stick with us. We’re here to break everything down so you can successfully start your short-term rental business in Florida. Speaking of, here’s what to know about…

Starting a short-term rental business in Florida

Unfortunately, creating a successful vacation rental business in Florida isn’t as simple as understanding the basic definition of a short-term rental property. Here are some other things you should plan for when starting your short-term rental business in Florida.

Florida Department of Business & Professional Regulation (DBPR) license

One of Florida’s statewide mandates for short-term rental properties is that if you rent a property more than three times a year for less than 30 days at a time or if you publicly advertise your property for rent in this capacity, you must acquire a Florida short-term rental license from the state.

This is known as the Florida Department of Business and Professional Regulation License (DBPR License for short).

How to get your Florida DBPR license

To apply for your Florida DBPR license, you will need to prepare the following materials:

- Address: You’ll need to supply both your home address and that of the rental property.

- Property Type: The DBPR has two separate application processes for either condominium or stand-alone dwelling STRs. Each application asks for slightly different information, so review that fully before submitting your paperwork.

- Classification: For rentals located in a larger occupancy building, you’ll need to indicate the type of building in which you plan to host a short-term rental by assigning it to one of three categories…

- Single: up to four units within one building

- Group: more than four units within one building

- Collective: up to 75 units in different buildings but within one civic district

Balcony inspection (DBPR HR-7020) certificate

If your STR will be in a building three or more stories high or has balconies at least 17 feet or more from ground level, you’ll need to have your balcony assessed by a certified inspector who can fill out the necessary inspection certification.

Human trafficking notification

Florida requires that any employees you hire to maintain your STR property or to greet and welcome guests be trained appropriately, a point to which you will need to agree in your application.

Associated fees

These fees, which vary depending on factors such as the county in which your short-term rental property is located and the number of units you plan to rent, can be calculated and paid directly online via the Florida Department of Business & Professional Regulation website. There is also a standard $50 fee associated with initial applications.

The importance of getting your short-term rental license in Florida

Acquiring a license to operate a short-term rental in Florida might seem like a lot of pointless paperwork. However, being fully licensed to own and operate a short-term rental business in Florida puts you on firm footing to grow your business.

Mostly, however, it ensures your short-term rental business is legitimate and thus potentially protects you from various negative consequences and other legal issues many encounter when trying to do things “under the table.” Registering your STR business might also be necessary to eventually apply for loans or establish separate bank accounts to manage your funds.

Florida short-term rental business license renewals

To keep your STR business running smoothly, once you’ve acquired your license from the state, it is imperative that you renew this license accordingly.

Florida requires that you renew your business license every year. You can typically complete this process online, though, meaning that after your first application, it’s usually a simple process of updating a few pieces of information and renewing automatically.

Start by visiting the Florida Department of Corporations and submitting the annual report for your business. Along with these reports, you must submit fees, which can vary between $25 to over $400, depending on the structure of your business.

Florida short-term rental: LLC or corporation?

Keeping track of the ever-changing Florida short-term rental laws can be a full-time job on its own, so keep in mind that you can always reach out to professionals for assistance.

Hiring a lawyer or an accountant, for instance, can help you feel more confident that you’re creating a firm foundation for your STR business. Moreover, these professionals can prove invaluable when helping you set up the right structure for your business, whether that be a:

- Corporation

- Limited Liability Company (LLC)

- Limited Partnership

- General Partnership

- Limited Liability Partnership

- Sole Proprietorship

While it’s ultimately best to speak to a legal professional, if you decide to set up your STR business as a limited liability company (LLC), the option offers a bit of a financial safety net.

Why is this the case?

Registering your short-term rental business as an LLC can be a good way to protect your assets. According to the rules of an LLC, your personal assets are considered separate from your business assets (and debts) and, thus, are protected in the event of a lawsuit involving your short-term rental business.

LLCs also offer the benefit of greater flexibility in how you choose to run your short-term rental business and manage your profits. State reporting requirements are relatively minimal. However, for more on the implications of an LLC for your short-term rental business, particularly in terms of tax implications, please visit the Florida Department of Revenue.

Required documentation to start your Florida short-term rental business

Regardless of your selected business structure, you’ll need to gather several documents to successfully apply for your business license application. These potentially include:

- Name of your short-term rental business: This can be a temporary name, like a DBA, or your legal name

- Articles of organization or incorporation: This applies to LLCs or corporations

- Necessary fees: The total amount will depend on your structure and needed documents—again, for a full list, view the latest Florida Division of Corporations fee chart)

You should also prepare yourself for future permits and licenses that you may need to apply for, depending on the location of your STR business properties. Namely, you’ll need to apply for your Employer Identification Number (EIN) from the Internal Revenue Service. Then, you will need to check local requirements for your short-term rental business (which we’ll cover in a later section).

Florida vacation rental tax rules

You’ve probably heard the saying that there are only two constants in life, and one of them is taxes. This is particularly the case in the State of Florida, where STR owners can plan to pay more than 10% of rental fees back to the county and to the state.

The different municipalities within the state, though, play a large part in determining your overall tax implications. Let’s look briefly at federal and statewide tax implications as a vacation rental business owner in Florida.

Federal tax implications

Broadly speaking, the United States government will consider your property a short-term rental if:

- You rent your property out for a minimum of 14 calendar days each year

- You use that property personally for no more than 14 calendar days (or more than 10% of the time that your property is occupied in a calendar year)

Meeting both of these requirements means you can maximize your potential federal tax benefits and deductions. Deductible expenses may include:

- Repairs and maintenance

- Insurance premiums

- Taxes (like the transient rental tax—more on this in the next section!)

- Utilities like water, gas, and electricity

- Supplies (think bed linens, bath towels, even wine glasses or pool toys)

- Legal and accounting fees

To maximize these deductions and to make the smartest moves when preparing your taxes, it’s best to work with your accountant. Regardless, our best quick bit of advice is to keep those receipts! You never know what you might be able to deduct as a business-related expense come tax season.

Florida’s transient rental tax

According to Florida Statute 212.03, all rental properties, including STRs, in the state of Florida are subject to what is known as the transient rental tax. This taxation rate is set at 6% (the same rate as the state sales tax rate) and means that 6% of rent paid to you as a STR business owner will need to be paid to the state.

For accounting purposes, it’s important to note that there are some rental situations where this 6% transient rental tax can be waived. This includes scenarios in which you are renting your STR to:

- A single renter/rental party for more than six months (as this bumps the property out of Florida’s definition of a short-term rental)

- A military veteran or active-duty service member

- A full-time student registered for postsecondary coursework

In the two latter cases, you should ask renters for written proof of their status—for example, an enrollment letter from a university or community college or documentation of official military orders.

Florida’s discretionary sales surtax

In addition to the 6% rental tax, Florida can also impose a discretionary sales surtax on short-term rental properties. This tax is typically between .5% and 1.5% of the total rental cost (this means not just the nightly fee but also any associated cleaning or reservation processing fees) and is assessed for any rental reservation that lasts for less than 182 days (or six months).

Local transient rental tax

Beyond the statewide transient rental tax and the discretionary sales surtax, each county in the State of Florida can also levy its own tax against short-term rental properties. This is known as the local option transient rental tax. It includes the County Tourist Development tax, which, as the name suggests, can vary between counties.

The highest rates, found in counties like Broward, which is home to Fort Lauderdale, match the state tax at 6%. The same goes for Duval County, where Jacksonville is located. Meanwhile, other counties, such as Calhoun or Lafayette, both of which sport a population of fewer than 15,000 inhabitants, charge no tax at all.

In addition to keeping tabs on the transient rental tax rates in the county that houses your short-term rental properties, you’ll also want to make a note of where and how to pay these local transient rental tax payments.

You’ll make most of these payments directly to the county. Roughly 20 counties in Floria, however, from Bradford to Washington, mandate payment of the local transient rental tax directly to the state’s Department of Revenue.

General Florida Airbnb and short-term rental rules

Congratulations: if you’ve made it this far in the process of setting up your STR business in Florida, you’ve passed the first major hurdles and reached a new landmark in our journey! You’ve learned about the necessity and requirements for getting a Florida short-term rental license, and you’ve (hopefully) understood what you can expect in terms of tax implications.

Now we can move on to the fun part: learning about the major rules and regulations that govern short-term rentals in Florida.

Below, we’ll also explore the rules, regulations, and fees associated with short-term rentals by city. Always remember that cities, as well as the state, have a voice in how you operate your STR business, so ensure you work to become an expert regarding what each city might ask of you (or employ the services of someone who is an expert).

The importance of understanding general short-term rental rules in Florida

A state like Florida has something for everyone: spectacular nature, thrilling theme parks, amazing wildlife, art, culture—the list goes on. Given this amazing “profile,” it’s not surprising that so many people wish to visit the state each year.

Millions of annual visitors means a lot of money is being poured into the real estate and hospitality sectors as tourists gobble up bookings for hotel rooms and vacation rentals across the state.

Pair this demand with the exponential growth of the short-term rental industry in the past two decades spurred by the success of industry leaders like Airbnb and Vrbo, and it becomes clear why Florida felt it imperative to set some ground rules for STR businesses.

Common short-term rental rules and regulations across Florida

Let’s take a look at some of the core rules shared across the state that are in place to help strike a balance between tourists and locals while also ensuring the safety and satisfaction of guests, hosts, and their larger communities.

Most major Florida cities include rules and regulations such as…

City registration and fees

Many major cities in Florida require short-term rental businesses to register their business and/or their properties with the city. These applications often are accompanied by fees, which vary widely depending on the municipality.

Some cities also require your STR business to attain city-specific tax numbers, but we will cover these later on a case-by-case basis.

Occupancy rules

Shared by many Florida cities is the requirement that short-term rental properties must be owned by you as the host. Those in condominiums or other properties overseen by a Homeowners Association (HOA) who want to rent out their space will need to gain approval from the HOA in written form.

In such an instance, you will also need to ensure that the HOA holds its own business tax receipt (BTR) number.

Moreover, some cities also restrict short-term rental properties by:

- Dwelling location: Many cities in Florida, particularly those that are larger and more populous areas, like Miami Beach or Fort Lauderdale, limit the zones in which you can operate a short-term rental.

- Occupant number: An additional consideration is that some cities in Florida, for example, Destin, also cap the number of occupants that can be hosted in one short-term rental. Again, these rules can vary, but generally speaking, those cities in Florida that cap occupancy limit capacity to two adults per bedroom.

Important update for 2024: Remember the SB280 bill mentioned above? This is one such instance where you’d need to ensure you’re paying attention to new Florida short-term rental laws and Airbnb restrictions to stay compliant. SB280 limits the maximum occupancy to two people per bedroom and an additional two people in a common area.

Safety regulations

Florida STR owners will also be expected to maintain an appropriate level of safety and security for their rental guests. This is important not only because it can keep your rental guests happy but it can also keep you in good standing in relation to being licensed as a short-term rental owner.

Keeping your properties up to code, ensuring the cleanliness of the facilities, and adhering to safety protocols are considered part of the DBPR licensing and renewal process. Accordingly, if your STR property is discovered to have fallen off in any of these categories, your DBPR license can easily be revoked. Ways that you can ensure your STR is adhering to these standards can include the following:

- Make sure you clearly state emergency information: This can include signs indicating the location of fire extinguishers or emergency exits throughout the short-term rental unit. This can even involve posting emergency contact numbers (like 911) for those who might be an international visitor to your Florida STR unfamiliar with these American resources.

- Designate a contact person in case of emergency: If you are operating your STR un-hosted, you can save yourself some stress by designating a contact person who is available for immediate assistance should anything in the STR go awry. This contact person is particularly important if you will be far away for a given time. From lost keys to noise complaints, there are myriad scenarios where having an on-call resource can be beneficial to accommodate your guests. Moreover, some Florida municipalities, such as the city of Naples, mandate that you identify this local contact person who will be “on-call” in case there are any issues with the short-term rental.

- Keep up with all of your community’s local building and safety codes: Regular maintenance for your short-term rental is not just a source of a tax deduction; it is imperative to make sure you are meeting Florida’s regulations that require that you keep your short-term rental up to code. This begins at the DBPR licensure stage, wherein you’ll need to provide proof of a balcony inspection, but can also be part of the STR permitting process in your Florida municipality. For example, Miami Beach mandates an inspection of your STR property by the fire marshall; meanwhile, cities like Jacksonville require that your STR permit application include surveys of your property.

Neighborhood restrictions

Also common to many Florida municipal codes relating to short-term rentals are articles that encourage the well-being of the overall neighborhood. These regulations can include restrictions on:

- Noise: Many Florida cities require short-term rentals to follow the rules of local noise ordinances. Holmes Beach, Florida, for instance, near Tampa, goes so far as to mandate in city ordinance Section 4.11 that the following statement be displayed in any STR in the vicinity: “You are vacationing in a residential area. Please be a good neighbor by keeping the noise to a respectful level during the day and night. Excessive and unreasonable noise can deprive neighbors of the peaceful enjoyment of their private property.”

- Parking: Some cities, like Fort Walton Beach, enforce parking limitations or restrictions for short-term rental properties to alleviate already problematic parking congestion near popular beach areas.

Now, let’s look at some of the major Florida cities to get a sense of how their requirements vary. This city-by-city review will expand on these general points by noting the key unique factors of each municipality’s codes when it comes to short-term rentals. Consider these variations, additions, and exceptions as further steps you’ll need to take beyond the general guidelines outlined earlier.

Short-term rental and Airbnb regulations by city in Florida

Now that we’ve covered some of the general rules that govern short-term rentals across the state of Florida, let’s hone in on some of the state’s more popular destination cities to help you understand what’s required of you to ensure you’re following local laws, too.

Clearwater Beach Airbnb and short-term rental laws and regulations

The quiet, beachfront neighbor to tantalizing Tampa, Clearwater Beach is a popular destination for those seeking some sun along the Gulf Coast. Given this, it’s probably not surprising that AirDNA reports average yearly returns for STR properties at more than $12.7k.

That being said, Clearwater Beach can present challenges to setting up a short-term rental business.

One of the biggest hurdles is CDC Sections 1-104.B & 3-919, which stipulates that the city does not allow short-term rentals of 30 days or less in any of the city’s residential districts. This is in line with the larger restrictions imposed by Pinellas County, which comprises much of Clearwater Beach as well as Saint Petersburg.

Don’t count Clearwater Beach out, though, on this accord alone. Rentals in residential districts of more than one month are permitted. Moreover, STRs can exist in areas zoned as “Tourist Districts” or “Commercial Districts” as defined by the city.

For STRs that fall into those districts, Clearwater Beach makes renting them out rather easy. Aside from mandating a City of Clearwater Beach Business Tax Receipt (BTR), Clearwater Beach forgoes the local permitting process and instead defers to the state’s general requirements.

Destin/Fort Walton Beach Airbnb and short-term rental laws and regulations

A thriving strip of beachside communities that connect Florida to Alabama in the east, The northern Gulf Coast of Florida’s shoreline includes hotspots like Destin and Fort Walton Beach. Given this popularity, it stands to reason that communities like Destin and Fort Walton Beach both have worked to establish regulations for STR properties.

Destin, in particular, has formalized the process with a series of rules similar to other nearby beach communities. To operate a short-term rental there, you need to:

Register your Destin short-term rental

Potential STR owners in the Destin area will need to apply for a short-term rental permit. Registration for this permit, as outlined in Article VI of the Destin Code of Ordinances, requires the following elements to be provided:

- Proof that your property is within one of the acceptable zones (as noted in city documents)

- A City of Destin Business Tax Receipt (BTR)

- A valid DBPR license

- A Florida Department of Revenue Resale Certificate

- A City of Destin Bedroom/Parking Affidavit

Keep an eye on capacity limits

Destin also mandates that capacity at each short-term rental property not exceed 24 persons at a given time. Moreover, Destin caps per bedroom capacity at two people, with the option of four additional persons per property.

For example, if you’re renting a four-bedroom home, you could host a maximum of ten people at that property.

Jacksonville Airbnb and short-term rental laws and regulations

The bustling city of Jacksonville boasts numerous major attractions and also serves as a hub for business, so it should come as no surprise that it makes for a great location to establish an STR business.

Following in line with Florida state statutes, the city of Jacksonville defines a short-term rental as any property rented on more than three occasions per year for durations of 30 days or less.

Jacksonville allows short-term rentals in residential districts in single-family homes, two-family homes, duplexes, and townhouses, provided that they hold a short-term Vacation Rental Certificate.

Applying for a Jacksonville short-term vacation rental certificate

To get your STR business in Jacksonville up and running, you will need to attain a short-term vacation rental certificate for each property you plan to rent. A complete application for one of these certificates includes:

- A short-term vacation rental certificate affidavit

- Local STR business tax forms

- Local tax receipt and tourist tax registration form for Duval County

- Evidence of your Florida Department of Revenue Certificate and DBPR License

- Detailed documentation of your proposed STR property, including:

- Sample lease

- Boundary survey

- Proof of ID for the property owner

- Property compliance inspection report

With all of these components in hand, along with a check for your permit fees, you should be well on your way to setting up your Jacksonville STR business. Annual fees for your Jacksonville short-term Vacation Rental Certificate are $150 (along with a $79.20 annual local business tax fee).

Miami Beach Airbnb and short-term rental laws and regulations

Similar to other major Florida cities, Miami Beach restricts the city zones in which short-term rental properties can exist. Some small districts offer limited areas for STRs, while much of the city prohibits them entirely.

For those lucky ones who own a property in one of these viable districts, you can establish an STR provided you hold a valid DBPR license as well as:

A Miami Beach business tax receipt number

Your Business Tax Receipt (BTR) Number is awarded by the city of Miami Beach. To apply, you need to supply:

- Your business’s Articles of Incorporation (if applicable)

- Proof of ownership of the proposed STR property

- A completed and notarized BTR affidavit

- Any insurance documentation you have for your business

You will also need to submit a business registration fee, which typically comprises a $69 license fee, a $45 application fee, and a $57.50 fire inspection fee. These various fees can be prorated depending on the time of year you apply (1 October marks the beginning of the Miami Beach fiscal calendar).

A Miami Beach resort tax certificate number

With your BTR in hand, you can then register for your Miami Resort Tax Certificate Number so that you can remit the necessary taxes to the city each month. To acquire this number, you will need to present your BTR along with your driver’s license number, social security number, and, if you are operating a STR business, your EIN and associated tax documentation.

Remember that all STRs are required to pay a 4% resort tax on room rental fees (as well as a 2% tax on any sale of food or beverage associated with the rental) to the city. You can file and pay that tax here.

Completing this process to attain these licenses and numbers can take some time, but the wait is worth it. Having both your BTR and Resort Tax Number in hand will not only ensure you comply with Miami Beach law, but it will also be necessary to list your property on STR sites like Airbnb.

City of Naples Airbnb and short-term rental laws and regulations

Perhaps responding to the ever-growing presence of short-term rental properties across Florida’s landscape, the city of Naples, for many years, prohibited all STR properties. Fairly recent legislation, though, has changed this rule, meaning that soon the STR market in Naples could be just as booming as other areas of Florida.

Setting up a Naples STR is straightforward, as well as outlined in these new regulations. All it requires, beyond holding a DBPR license and agreeing to pay the Collier County Tourist Development Tax, is the registration of each STR property.

City of Naples STR registration

Effective January 2, 2022, all short-term rentals of single-family, multi-family, and condominium residences in Naples have to be registered with the city. To apply for this registration, and in accordance with new city ordinance 2021-45, all STR owners need to submit:

- Proof of their current Florida DBPR License

- A completed Collier County short-term vacation rental application (which includes providing the contact information for a responsible party available 24 hours a day/ seven days a week to respond to renter/neighborhood concerns)

- Proof that the STR owner has registered with the county (to ensure tax filings are accurate)

- A $50 one-time registration fee

Once registered, STR owners will receive a number that they can provide to ensure their property is in compliance.

Orlando Airbnb and short-term rental laws and regulations

The home of some of Florida’s most iconic theme parks, Orlando is a perennially popular destination among travelers. Visit Orlando, for example, recorded more than 74 million visitors to the city in 2022 alone. Sounds like an ideal locale for a short-term rental business, right?

Not so much: Orlando has some of the most restrictive short-term rental laws in the entire state, at least where single-family homes are concerned. This is perhaps partially owed to the fact that elsewhere in Orange County, STR listings like those found on Airbnb are not permitted.

Before 2018, Orlando outlawed all STRs, too; as of 1 July that year, however, Orlando changed its policies to allow for two types of short-term rentals.

Home-Sharing

You can use your single-family home or other accessory dwelling units as an STR provided:

- You are the owner and full-time resident at the property (Orlando prohibits the short-term rental of entire, unhosted units; only home-sharing is approved)

- You rent to only one party (or parties) at a time

- You rent no more than half of the bedrooms in your dwelling

- You maintain a capacity of no more than two people per room and no more than four non-relatives per dwelling

While these stringent home-sharing rules can curtail STR business, they do come with the benefit that home-share STRs can exist in any zoning type in the city.

Commercial Dwelling Unit

Those who own commercial dwelling units, such as a vacation rental condominium, can rent the entire unit but cannot operate in a residential zone of the city.

Once your application is complete, the city will issue you a permit number in exchange for a $275 fee. This permit number is renewable annually with an additional fee of $100.

Pompano Beach Airbnb and short-term rental laws and regulations

Echoing the laid-back vibe of its location between Fort Lauderdale and Boca Raton, Pompano Beach provides some of the more lenient short-term rental rules of the myriad Floridian beachfront communities. Let’s take a look at these regulations below.

Short-term rental permit

Per city ordinance no. 2017-50, to operate an STR in Pompano Beach, you’ll need to apply for a short-term rental permit. To complete this application, you will need to provide:

- Proof of your current DBPR License from the state

- Proof of your registration with the Florida Department of Revenue

- A copy of your Broward County Business Tax Receipt (BTR)

- A copy of your Pompano Beach Business Tax Receipt (BTR) (achievable only after you successfully attain your Zoning Use Certificate)

- Documentation that your STR property is free of liens or other code violations

Also accompanying your application should be a copy of the lease you will use with renters as well as an interior floor plan and exterior site plan. Don’t forget your application fee as well, which totals $675 for single or two-family homes and $750 for multi-family homes. These permits need to be renewed annually at the cost of $375.

Saint Petersburg Airbnb and short-term rental laws and regulations

Locally known as the “Sunshine City” in the “Sunshine State,” Saint Petersburg sits along one of the most coveted stretches of Florida’s endless coastline. Because of that prime location, though, it seems that establishing an STR business in Saint Petersburg can be a bit of a challenge.

If you wish to rent your STR for stretches longer than 30 days, you are permitted to do so anywhere in the city. In addition, if you hold an STR property in a part of the city zoned for hotel occupancy, you are also in the clear.

For those wishing to rent their units for less than a month at a time outside of these hotel zones, options in Saint Petersburg are relatively limited. Such STRs can operate only on the proviso that they are rented only up to three times in any year period.

Anyone who wishes to operate a Saint Petersburg STR will need to provide proof of a Business Tax Certificate Receipt as well as their DBPR license.

Sarasota Airbnb and short-term rental laws and regulations

Sarasota might attract a wide array of tourists thanks to its beautiful beaches and impressive art collection housed in the Ringling Museum of Art. It might not be that attractive, though, for those aiming to set up an STR business.

In late 2021, the City of Sarasota outlawed super short-term rentals by mandating that no lodging could be rented for less than seven calendar days and nights in any residentially zoned district. However, that doesn’t mean you can’t still list your property in Sarasota, especially given recent changes in 2024.

On February 5, 2024, the Sarasota City Commission passed Ordinance 24-5506. Regulations are still the same in that you cannot have guests stay for shorter than seven days and nights, but as of 1 July 2024, the city will start accepting applications for vacation rentals situated on the mainland.

Tampa Airbnb and short-term rental laws and regulations

One of the last of its kind in Florida and the antithesis of Sarasota when it comes to STRs, Tampa currently has a relatively unregulated market for short-term rentals. It is governed by state laws, and thus those operating an STR business in Tampa need to ensure their property licensing and tax documentation.

Meanwhile, Hillsborough County, which contains the metropolitan area of Tampa, offers a few more restrictions. The main concern on the county level is that those properties rented for seven days or less at a time can only operate in certain city zones. Beyond these state rules, though, Tampa is currently a pretty inviting market for STR investors.

FAQs about Airbnb and short-term rentals in Florida

Now that we’ve covered the basics for short-term rentals in Florida, and have also highlighted some of the key regulation differences between the state’s popular cities, let’s turn to some frequently asked questions (FAQs) to provide some more clarity on key points.

I want to break into the STR business in Florida. Where should I begin?

This is a great – but also a tough – question. It is difficult to answer because there are so many factors that can contribute to where you decide to invest in short-term rentals and build your business. That said, we have a few helpful points that might help you get on the right track.

- Do your research: it’s safe to say that, given its beauty and brilliant weather all year long, Florida will not be going out of style soon. Nevertheless, some markets are “hotter” than others, so it would be good to read up on some of the pressures that are driving up prices in some locations (or driving them down in others).

- Frame your concept: once you have a sense of the landscape, we recommend next thinking about what type of business you hope to establish. Are you thinking of investing in numerous properties that will be your main source of income? Or, are you imagining the STR market as a path to homeownership or just want to create a smaller-scale, boutique experience? Having an idea of where you see your STR business going can be invaluable, even before you sit down and start to fill out license applications and tax forms.

If you start here and work through each of our sections in this book, you should be on firm footing.

I had a little “sticker shock,” having just paid hundreds of dollars for my short-term rental permit. How long are these valid?

It is hard to say exactly as different cities follow various practices when it comes to city-specific permits for short-term rentals. That being said, the majority of Florida locations require renewal of your local STR license or permit each year. The good news? The renewal fee is often less than the initial application fee.

I’ve read about the transient rental tax imposed by the state of Florida on short-term rentals; are there other taxes I need to keep in mind?

Yes! The transient rental tax is the statewide component of the tax levied on STR units; you’ll also need to account for the Discretionary Sales Surtax and the Local Option transient rental tax.

The former, which is typically a fraction of a percentage, is paid to the state but then redistributed at the county level; the latter, which can be between 0-6%, typically goes directly to the counties themselves.

As a self-managed short-term rental business proprietor, how am I to keep track of all of these taxes?

One way you can ensure you are logging the correct amount is to earmark the percentage needed for both state and local taxes when running through your accounting books each month.

This could be as simple as setting up a formula in a spreadsheet, but if accounting isn’t your strong suit, you could also hire a freelance accountant to keep your invoices organized. Even simpler still would be to take advantage of STR listing sites.

Sites such as Airbnb, however, can deduct these payments for you, which is a major advantage. So, if you want one less accounting headache to manage as you get your short-term rental business up and running, this perk is yet another reason to list your properties on sites like Airbnb.

Are there any ways I can get a tax break when renting out my STR?

Yes: it is possible in certain scenarios to save a bit on the state rental tax. Florida statutes permit you to waive the 6% state rental tax if your renter can provide proof of being an active-duty service member, a military veteran, or a full-time student.

In this context, proof takes the form of documentation: a letter from a college or post-secondary program that confirms your renter is enrolled or an active duty order from a renter’s military team commander.

You can also waive this tax if you rent to the same person for more than six months. However, this is because, then, the terms of your rental agreement would no longer fall under the short-term rental rules.

What does it mean to “host” a short-term rental?

In short-term rental lingo, the “host” is the individual who greets the renter(s) at the property and stays with them at that property (in a home share arrangement where you rent one or several rooms). An unhosted property, then, simply refers to an STR unit where you/the owner is not present while the unit is being rented (in other words, instances of a whole house rental).

Are a “short-term rental” and a “short-term lease” the same thing?

Not necessarily: the phrase “short term” can scale dramatically depending on the scenario at hand. Typically, “short term rental” refers to the renting of a property for 30 consecutive days or less. At least, this is the working definition for a short-term rental in Florida.

A short-term lease could be for the same duration. However, it could refer to a three, six or even nine-month contract (really any duration less than a year). Because of this, when setting up your STR business, you will need to make sure that you are identifying your rental/lease terms appropriately.

I want to use my home as a STR but currently have a Homestead Exemption on it. Can I keep this perk while also earning some extra income by renting?

It is possible to use your property as an STR while also keeping a homestead exemption, which helps to reduce your property tax burden. According to Florida state statute section 196.061 (1), you can keep your exemption provided that you do not rent your property for more than 30 days a year for two consecutive years.

This means that, while you would not be able to rent your property full-time, you could establish a means to begin building your STR business while also saving some on your property taxes.

How much money can I make establishing a short-term rental in Florida?

It is difficult to predict profitability for a short-term rental in Florida. Making it even more challenging is that the data reported from 2020 and 2021 can be misleading, with tourism and travel lingering near record lows due to the pandemic.

Nevertheless, a big-picture glance provides some promising numbers. For instance, Alltherooms.com reported that in 2020 Airbnb hosts in the state of Florida earned an average of $28,012; in 2021, that number nearly doubled to $53,209 and has since continued to increase. This puts Florida in the top six states in terms of STR earnings among all other states.

A final word about Florida’s short-term rental legislation

Florida really has it all: it is a state that will perennially be associated with everything from relaxed beach vibes to exceptional cultural enrichment and entertainment. Some come for flying roller coasters; others come for SCUBA diving; still others come to simply get away from it all.

Given this ideal combination, it seems there will always be a demand for short-term rentals in the Sunshine State. So, why not join the market? Starting your own STR business in the Florida means joining the many others who have caught on to the potential profits and pleasures that running a short-term rental business in Florida can bring.

These folks are successful because they’ve done their homework. They stay on top of an ever-evolving set of Florida short-term rental rules and regulations that govern how they operate their businesses, and their diligence has typically paid off with an enduring list of clientele and an (appropriately) filled calendar of bookings.

On a final note, particularly for those who might still feel a bit overwhelmed with all of the factors that are involved in establishing a successful STR business in Florida (or any other state for that matter): it can get easier. Many of the “hoops” to jump through noted here occur in the early days of your STR business.

Once you’ve navigated those hurdles, keeping your STR business on a level track becomes much easier. For example, the first STR permit might take some time, but the next will be faster, as will the next, and the next…and so on. In other words: you can build your STR business knowing that it will only become more rewarding as time goes on.

Manage Florida short-term rentals with Lodgify

Not convinced that managing your short term rental will become easier? We get it—the thought of building your own STR business from the ground up is scary! If keeping tabs on Florida short-term rental regulations seems like too much to handle, or if you’re already juggling other professional “hats” and don’t have the bandwidth to add another into the mix, don’t stress: vacation rental software can help.

Lodgify is one of the industry-leading software designed to help you manage your short-term rental properties. Its comprehensive, centralized platform allows you to oversee all of your properties in one space. Furthermore, Lodgify allows you to create your own direct booking website to streamline the booking process and also syncs your calendars across any third-party hosting sites, like Airbnb, on which you promote your property.

Looking for simplicity in managing your Florida short-term rental business? You needn’t look any further than Lodgify. Experience the benefits now by starting your free 7-day trial.