Summary:

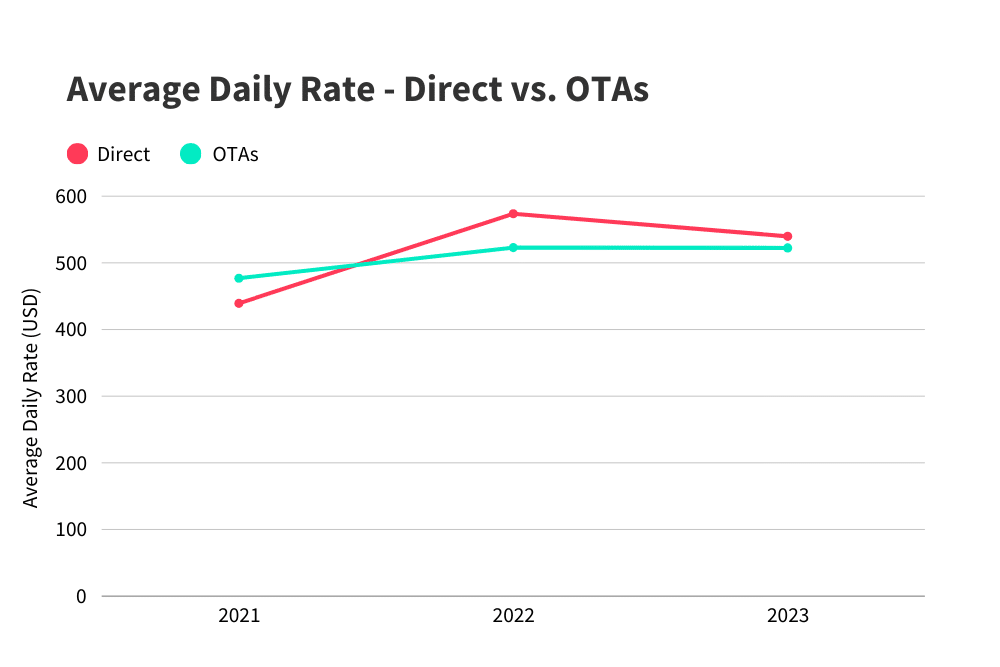

- Dreams of affordable holiday trips might just come true this year. Average daily rates (ADR) for holiday bookings have decreased by 2% since 2022.

- Going direct is even more affordable for guests in 2023, with a 5.9% year-over-year drop in ADR for direct bookings.

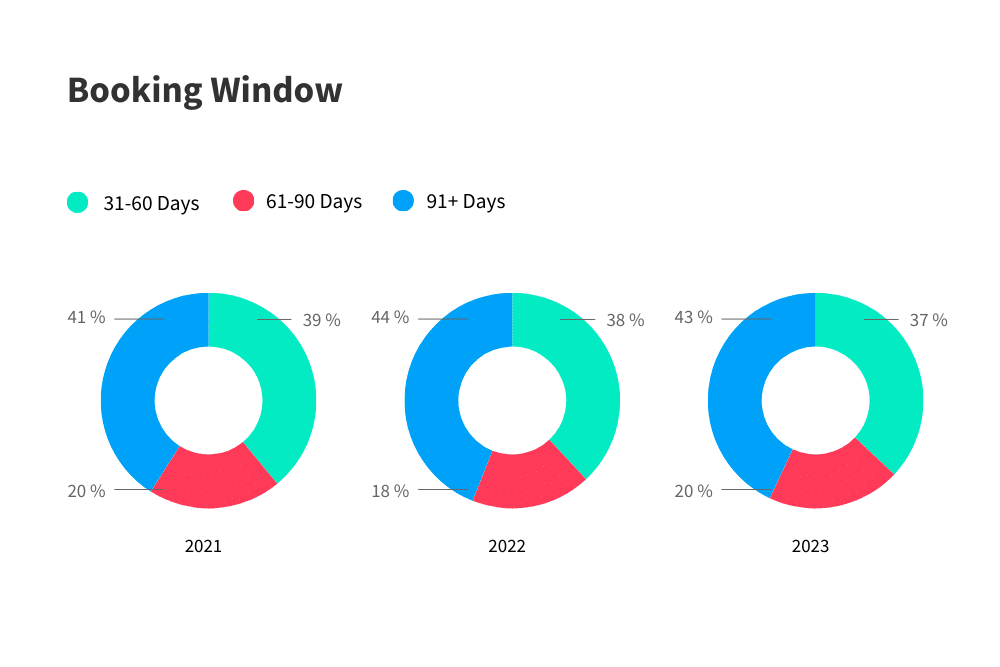

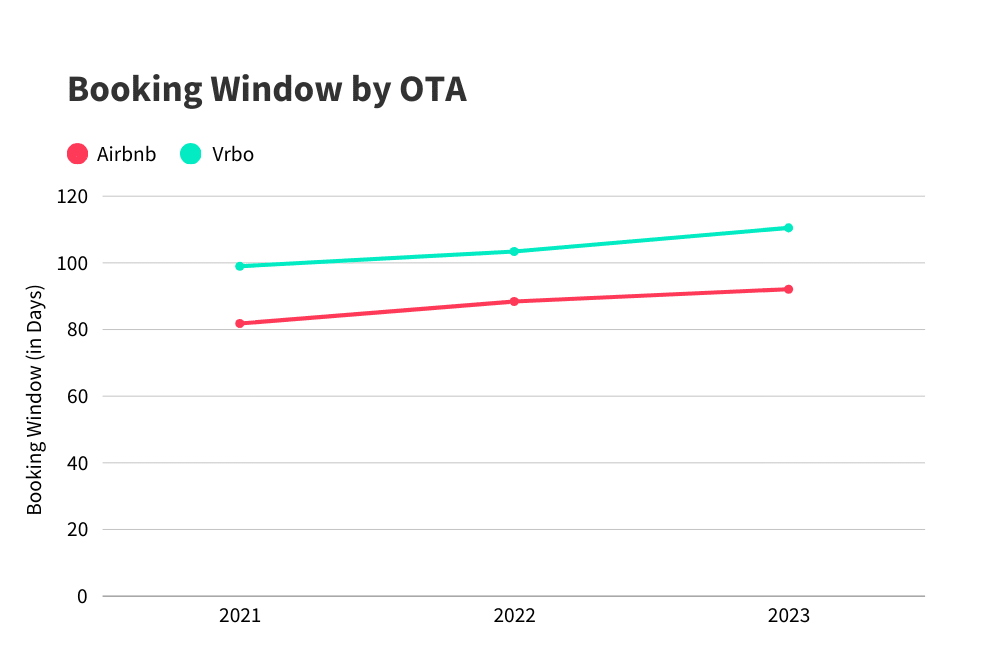

- Guests aren’t afraid to book early. 63% of bookings are being made at least two months before the holiday period. The booking window is increasing across all the most popular listing channels.

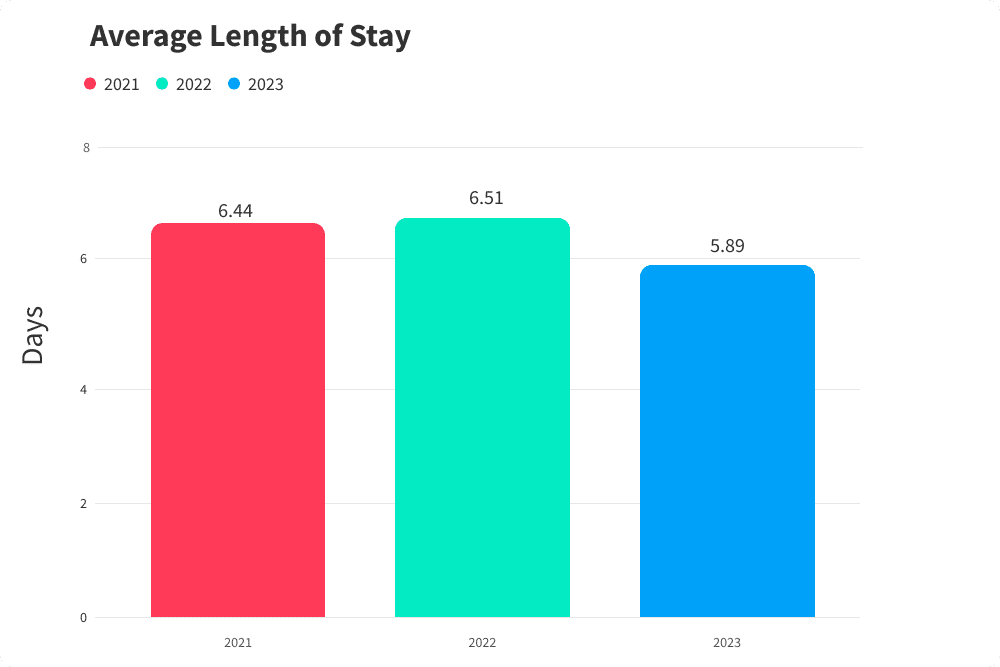

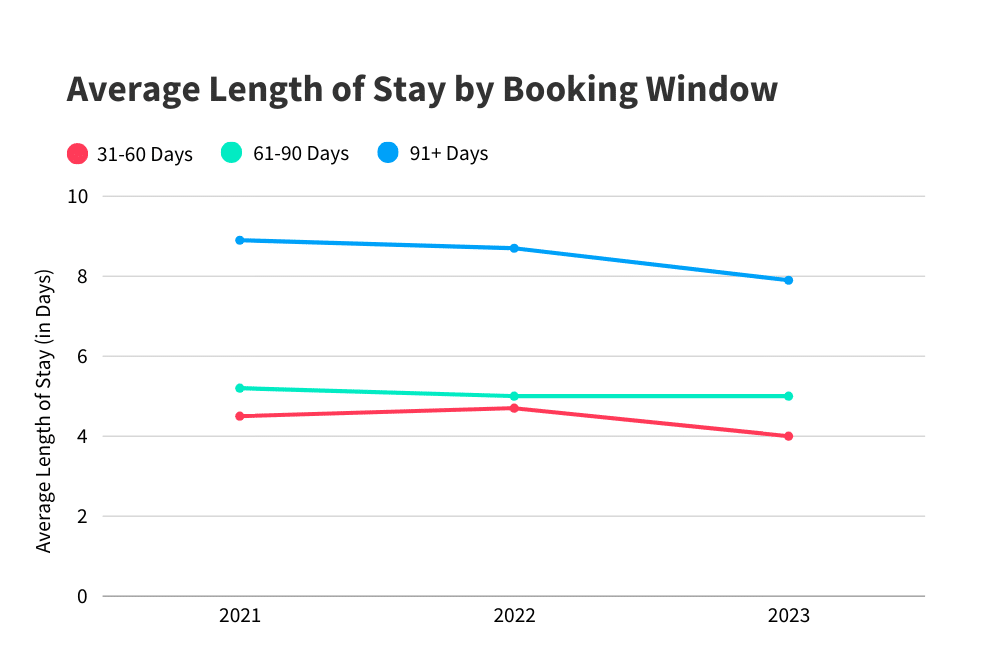

- No one’s getting snowed in this year (they’re just not staying long enough to!). Average length of stay (ALOS) is down by 9.5% since 2022. And trip length is getting shorter regardless of how far in advance travelers book.

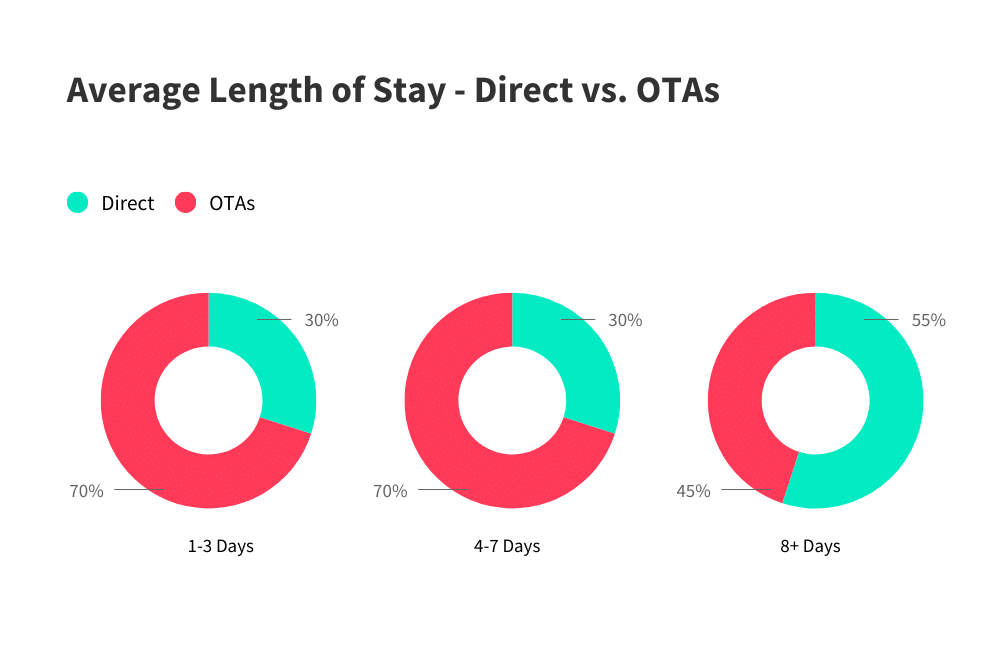

- All hosts want for Christmas are direct bookings—and for longer stays, they’re getting them. 55% of holiday reservations made for 8+ days have come through direct booking channels.

Whether or not Santa Claus is comin’ to town, hoards of travelers are as they make their way to holiday celebrations. With the winter holidays only weeks away, everyone has their eyes set on joyful reunions and yuletide fires.

Fortunately, we have the perfect gift to help vacation rental hosts prepare for this bustling season: a report on all the booking trends they can expect to see.

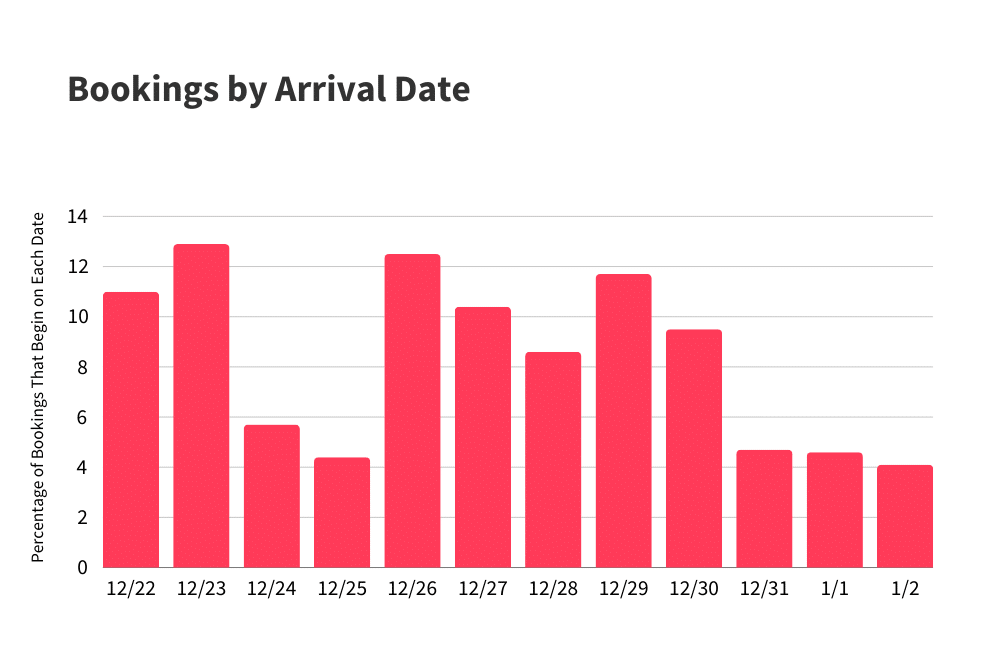

For the purpose of this report, we’ve analyzed all U.S. bookings in 2021, 2022, and 2023 that have an arrival date between the Friday before Christmas Eve and January 2nd (see our methodology section for specific date ranges). We’ll be focusing only on bookings made up to one month before this observation period to ensure any comparisons are as relevant and accurate as possible.

In addition to the data itself, the downloadable version of our report incudes actionable insights and strategic recommendations to help hosts maximize bookings and enhance their guest experience. To download the full report and receive a stocking (well, PDF) full of top tips, simply fill out the form below!

So, grab some hot chocolate and let’s dive in to the trends, patterns, and strategies that will define holiday hosting success in 2023.

Don’t see the form to download the 2023 holiday report? Click here.

Snow is falling (and ADR!)

In the festive landscape of this year’s holiday season, the short-term rental market has taken a slightly unexpected turn. While the past few years have witnessed a consistent rise in average daily rates (ADR), this year, we’re unwrapping a 2% decrease from last year, with direct bookings being 5.9% cheaper than in 2022.

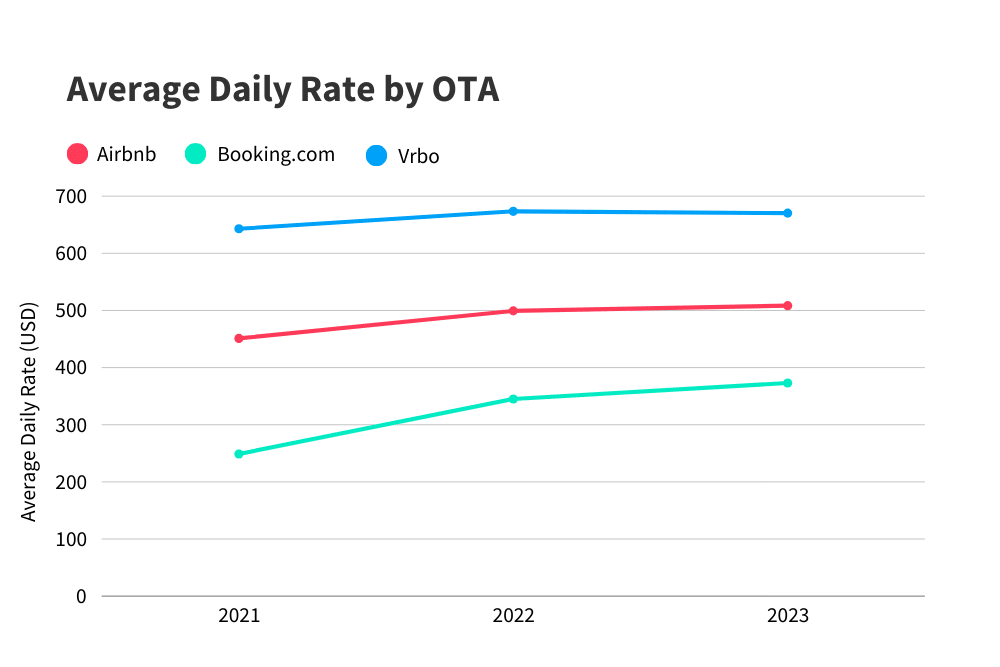

For example, Airbnb’s ADR shot up by 10.7% from 2021 to 2022. However, this year, we’re only seeing a 2% jump year-over-year. Similarly, ADR on Booking.com increased by a whopping 39% year-over-year from 2021 to 2022 but only by 8% from 2022 to 2023. Meanwhile, changes in Vrbo’s ADR are a lot less dramatic. It increased by 5% from 2021 to 2022, while this year it remains almost identical to last year, adding a dash of unpredictability to the holiday saga.

Why are the holidays getting cheaper? Or are they?

Well, it depends on how you look at it. As anticipated, the surge in demand and a subsequent increase in supply for short-term rentals has caused a slight reduction in ADR across all bookings. It’s likely that many hosts have responded to the increased supply by lowering their rates in order to stay competitive and stand out in a crowded market.

However, ADR has increased when it comes to holiday bookings through Airbnb and Booking.com. One of the main factors could be that daily rates for apartments have risen by 7.5% from last year, a listing category that typically does very well on both booking platforms.

Meanwhile, we’re seeing a 5% decrease from 2022 to 2023 in cost for houses and villas, Vrbo’s largest category. This may be responsible for the cheaper bookings we’re seeing there.

When it comes to direct bookings, hosts could be lowering the ADR on their own websites in an attempt to maximize their booking revenue. With many booking platforms charging commissions of 15-20%, encouraging guests to book direct this holiday season could help both hosts and guests avoid having to pay substantial third-party fees.

‘Tis the season to book in advance

Travelers are breaking out their advent calendars early to plan their holiday trips well ahead of time.

Of course, this report focuses solely on bookings made up to one month before the holiday season and can’t analyze last-minute reservations. But still, we’re seeing that 63% of these bookings are being made at least two months in advance of the holiday period this year. And 43% of bookings are made at least three months in advance.

This is consistent with data from both 2021 and 2022, when 61% and 62% of bookings, respectively, were made at least two months in advance. 41% of bookings were made over three months in advance in 2021, and that percentage grew to 44% in 2022.

What’s spurring advance bookings?

Average daily rates are down, so why are people booking so far ahead of time?

A couple of factors could be at play here.

On the one hand, budget travelers will always try to get the best deal possible. Less money spent on accommodations leaves more leftover for gifts and a delicious holiday spread.

But we also wonder—could revenge travel be playing a role?

People are still eager to travel as much as possible to make up for Covid trip cancellations. In fact, 49% of Americans planned to travel more in 2023 according to a study for Forbes conducted early this year. So, it could be that travelers are simply eager to sort out the logistics of their holiday trips as they make their annual travel plans.

The most wonderful time of the year is getting…shorter

Like Frosty, guests are hurrying on their way this holiday season.

We’re seeing a 9.5% decrease in average length of stay (ALOS) since 2022. While trips averaged 6.51 days last year, they now come in at just under six days (5.89).

Shorter stays = less holiday spirit?

So, why aren’t travelers taking advantage of their advanced planning and lower rates to stay for longer this holiday season?

Rather than chalk it up to a lack of holiday spirit, it might have something to do with inflation.

Of course, inflation is now on the decline, but it’s still above pre-pandemic levels and above the Federal Reserve’s target. It’s fair to assume that inflation is still affecting people’s travel choices.

It’s also possible that people are simply shortening their trips this holiday season in order to travel more throughout the rest of the year.

As we explained above, nearly half of Americans planned to travel more in 2023. But that doesn’t necessarily mean that they have more vacation days, and taking shorter trips might enable them to take more trips.

Travelers continue to book directly for longer trips

Some final good news for hosts: 55% of holiday reservations made for 8+ days have come through direct booking channels. This is in keeping with what we saw this summer, when 56% of bookings of this length came from direct.

Nevertheless, the fact that travelers continue to seek out direct booking channels to book longer trips represents a significant revenue opportunity for hosts.

Who wants to pay more?

Third-party fees and commissions aren’t on anyone’s Christmas list this year. Guests likely turn to direct channels for longer trips to avoid these extra expenses, which can really rack up the longer the trip.

Travelers may also prefer direct booking channels for longer stays in order to communicate more directly with owners. The longer the trip, the more important it is to have an easy point of contact whom you can trust.

Let it snow (bookings)

This year, guests are booking in advance and taking shorter, budget-friendly trips.

The positive side? They can enjoy fantastic savings with direct bookings thanks to the lowered ADR. This drop in rates opens up more affordable choices for guests, making it even more enticing to opt for direct bookings and secure an excellent deal.

And there’s a bright side for hosts, too.

Optimizing your listings early can help you capture advance bookings and potentially fill your reservation calendar earlier than ever. What’s more, investing in direct channels with a direct booking website will help you book longer stays (and secure that extra revenue).

Not a bad Christmas present, right?

And as one last gift, we’re providing this year’s industry report in PDF below along with actionable tips to make the most of these findings. Download it now to get instant access to these insights and finish prepping for the 2023 holiday season.

Don’t see the form to download the 2023 holiday report? Click here.

Methodology: how we created this report

We’ve analyzed more than 32,000 U.S. bookings within Lodgify’s internal data, including direct and OTA bookings. Our analysis focused on bookings made up to one month in advance of the Christmas and New Year’s holiday in 2021, 2022, and 2023. For the sake of this report, we’ve defined this period as lasting from the Friday before Christmas Eve through January 2nd. Specific date ranges for each year are as follows:

- December 24, 2021 – January 2, 2022

- December 23, 2022 – January 2, 2023

- December 22, 2023 – January 2, 2024

For statistical purposes, we’ve filtered out outliers that would have impacted the final results.