Summary:

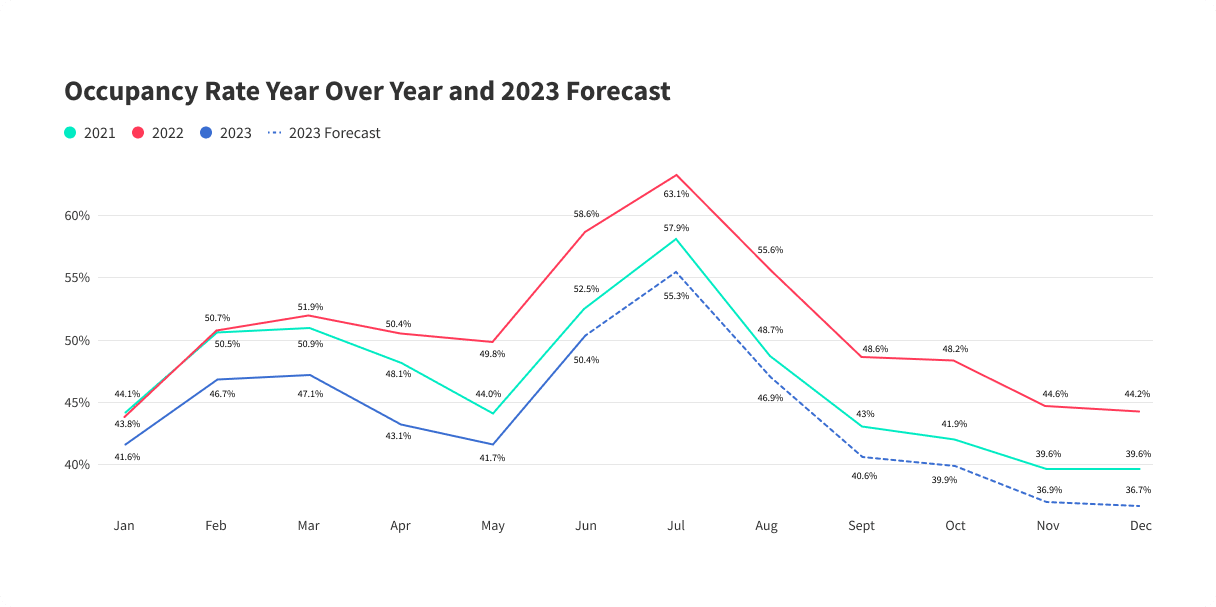

- Occupancy rate: Summer occupancy rates have dropped from 2022 by 8%.

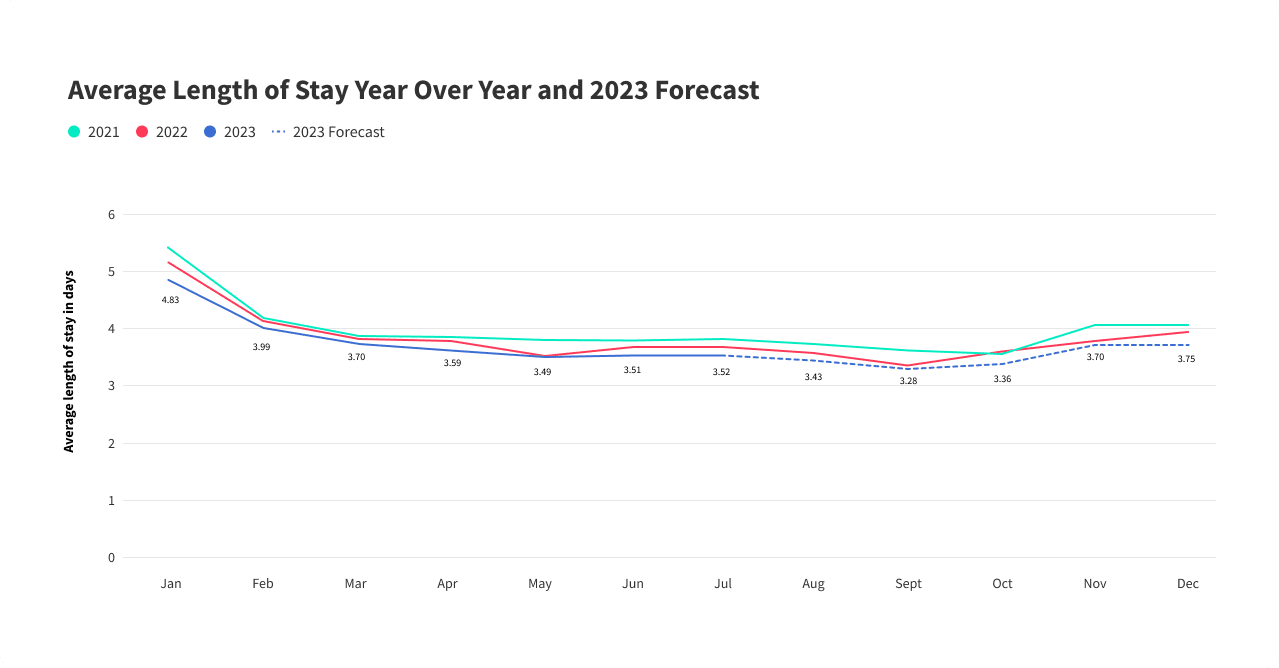

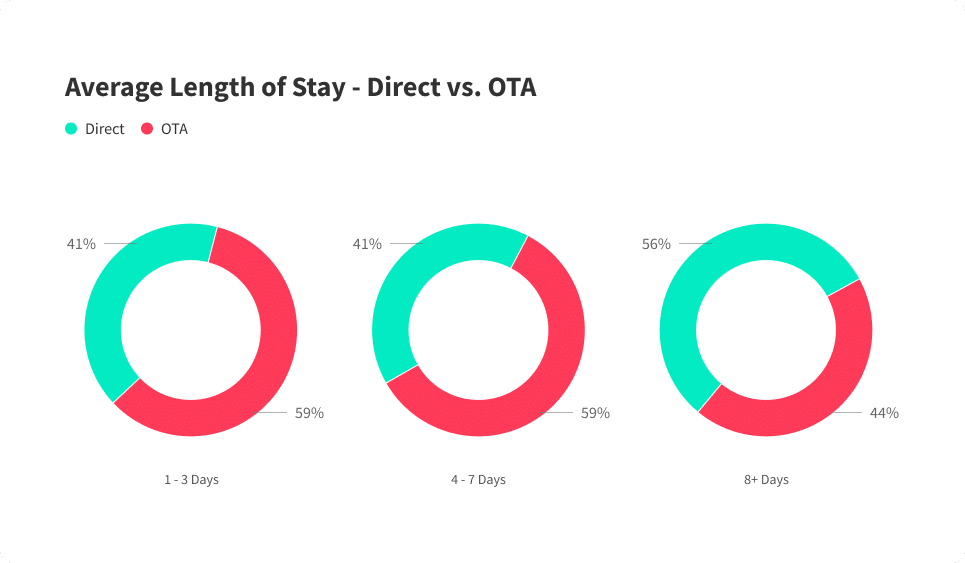

- Average length of stay: Guests are booking shorter vacations this year compared to last year, but 56% of all 2023 reservations of 8 days or more are coming from direct booking channels.

- Average daily rates: The general summer trend sees ADR drop by 3% compared to 2022.

- Holiday specials – Fourth of July: Despite the overall drop in ADR, daily rates have increased year-over-year for Fourth of July bookings. Additionally, last-minute bookings for Independence Day saw an increase of 5% compared to 2022.

- Holiday specials – Labor Day: 38% of all registered bookings for Labor Day Weekend are direct bookings.

Don’t see the form to download the Industry Report? Click here.

For most property managers in the United States, we are approaching the peak season—a crucial time that can make or break the year for many businesses. There will be increased optimism after the superb numbers the industry boasted in 2022, and with travel restrictions all but gone, it’s no surprise that many are hoping to toast to even more success in 2023.

However, it’s not looking as straightforward as that. More short-term rentals are operating this year, which appears to be playing its part in the overall drop in this summer’s average daily rates, occupancy, and average length of stay.

We’ve analyzed more than 740,000 bookings of internal data, from Lodgify customers in the United States, between January 2021 and June 2023 to build this report. Its aim is to identify the key changes in this summer’s U.S. short-term rental industry trends that all property managers should be aware of.

Firstly, we’ll look at booking insights for the summer in general, based on data for the months of June, July, and August, and then we will zoom in to look at the forecasted trends for the two main summer holidays in the U.S.: the Fourth of July and Labor Day weekend.

So, as the warm sun beckons and the sound of waves grows louder, it’s time to dive into this summer’s vacation rental industry insights.

Industry Report video summary

Summer 2023: Slump in vacation rental occupancy

The easing of travel restrictions boosted the industry’s occupancy numbers in the U.S. last year. July 2022 saw a peak occupancy rate of 63%, which is compared to 58% for the same period in 2021. However, July 2023 is only expected to reach an average 55% occupancy rate, which is a hefty drop from last year.

How does that make sense?

Well, more businesses are open this year, meaning there is an increase in supply with even more rentals on the market. This gives travelers more options when it comes to booking their summer vacation, so inevitably, there will be many rentals with less occupancy.

Time to stand out from the crowd

You’re going to have to get creative to attract those guests on the lookout for their summer vacation home. Try marketing your rental differently by focusing on enhancing your guest experience and not just your property’s best features.

Remember, potential guests booking a vacation rental, as opposed to a traditional hotel, are looking for something special. Let them know their experience will be tailored to their needs and that your customer service is second to none. Reviews and word-of-mouth are powerful—and free—marketing tools to exploit.

Shorter stays, but with a big twist

The U.S. STR industry has so far had a lower average length of stay (ALOS) per booking in 2023 than in the previous two years. June has had an average length of stay of 3.52 days, the same figure as expected for July. However, the forecasted ALOS for August looks like it will be slightly lower, with 3.43 days.

Meanwhile, looking at the chart below, we can see that 59% of bookings for reservations of 7 days or less are made through OTAs. However, the picture is very different when we focus on long-stay bookings: 56% of all 2023 reservations of 8 days or more are coming from direct booking channels – an amazing revenue opportunity that property managers shouldn’t neglect!

Why direct for longer stays?

Guests can sidestep those extra third-party fees and commissions by booking directly with the owner. Another suggestion would be that guests prefer to book longer stays directly so they can build a relationship with the owner through direct communication. This helps guests trust the owner more and feel confident about spending their money on an expensive vacation.

Want those long-stay bookings? Invest in your direct channels!

So, if you haven’t already, invest in a direct booking website this summer if you’re looking to capture those longer stays. Remember, communication is key here. Your potential guests have likely already decided to part with their cash for a summer getaway, so they’re looking for a place—and an owner—they can trust.

Set up custom automated messaging through your PMS to ensure quick and efficient responses to any guest queries.

Summer daily rates down by 3%

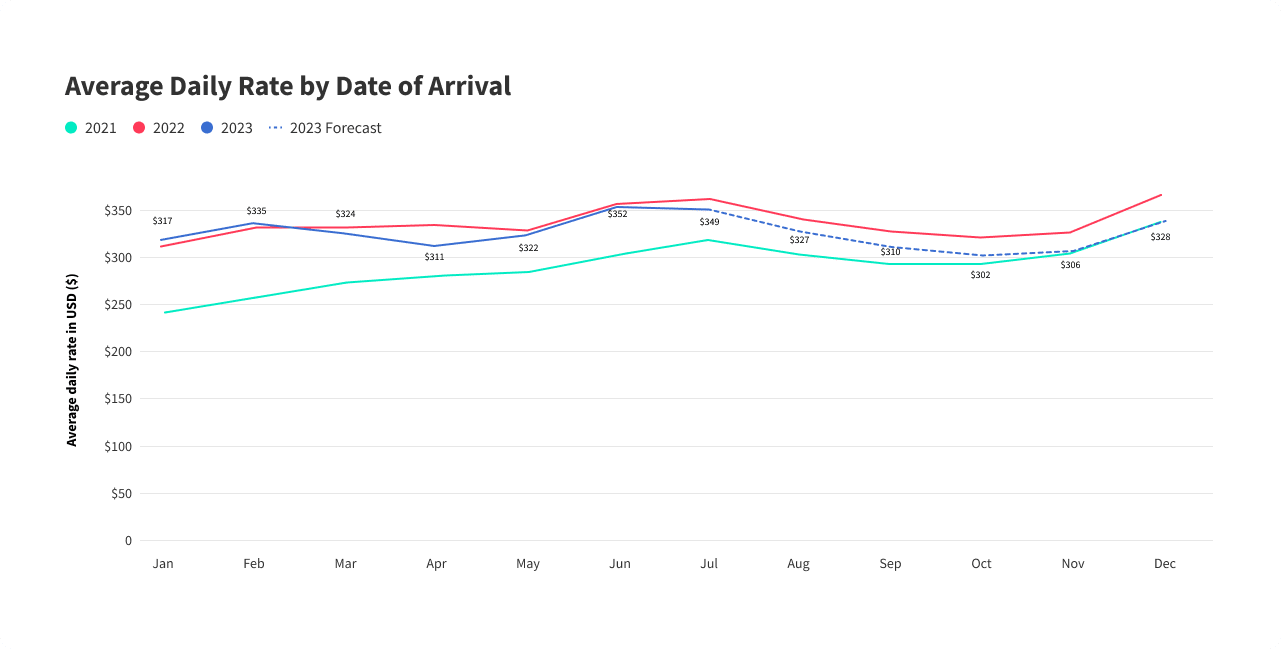

When looking at the average daily rate (ADR) for the summer months (June, July, and August), we can see a large increase in pricing between 2021 and 2022. Businesses that were fortunate enough to open and welcome guests in 2021 provided cheaper experiences to encourage the return of guests and increase confidence in the travel industry.

In 2022, as travel restrictions eased, guests were keen to make the most of their renewed freedom and were willing to pay premium prices for a long overdue vacation.

In 2023, we are seeing a slight drop in ADR, with current estimates suggesting that June has decreased by $4 per night. Furthermore, July will be $349 per night, 4% lower than in 2022, and August’s expected ADR of $327 is also a decrease of 4%.

Although it’s predicted that the number of travelers will be even higher this year than last year, along with an increase in supply as new businesses open, this heightened competition for guests has prompted businesses to offer lower rates in order to capture more bookings.

Why the drop despite the optimism of last year?

Well, it’s possible that last year’s higher inflation rate forced property managers to raise their rates to make up for their increasing expenses.

Keep your prices competitive and master the art of niche targeting

Over the next few months, focus on keeping your prices competitive, and look at other ways to encourage guests to book your property. Try targeting a niche audience that may find your rental particularly appealing and up your social media game to build brand awareness.

Summer calendar looking empty? Don’t sweat!

If you’re looking at your calendar and wondering when or if your summer bookings will arrive, don’t sweat—because there’s still time!

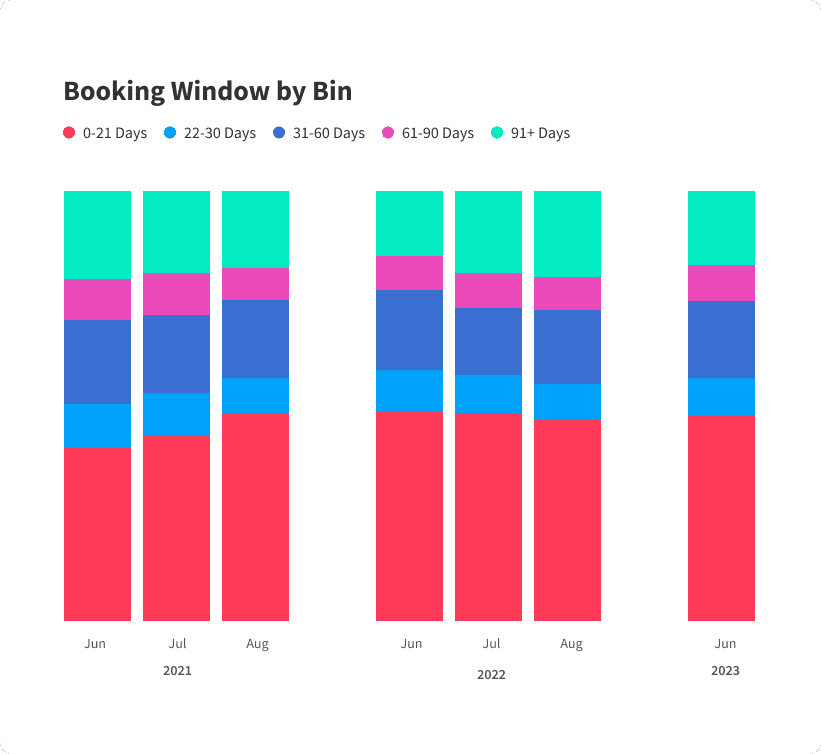

In the summer months of 2021, 44% of all bookings were made within three weeks of the arrival date, and in 2022, this jumped to 48%—almost half of every booking made for summer.

This year, the trend continues, with 48% of June’s bookings also being last minute. This means there’s still plenty of time for your calendar to fill up; just make sure you’re ready for them!

Why are they waiting so long?

One of the potential reasons could be the summer’s decrease in occupancy rates, meaning there is more general availability, therefore, less pressure to book early. Also, the prospect of enjoying a luxurious getaway without breaking the bank is simply too tempting to resist, and enticing nightly rates for last-minute deals have a way of capturing guests’ attention.

And let’s not forget about the power of mobile phones. With just a few taps and swipes, guests can quickly book their vacation rental property, even at the very last minute.

Efficiency and flexibility are key

As the expression goes, ‘fail to prepare, prepare to fail’. Capturing last-minute bookings is all about prep—and being really good at it. Make use of your PMS’ automation features so you can send quick requests to your cleaning team, ensuring that your property can be ready for guests as soon as possible.

Additionally, install a keyless and contactless check-in system so that guests can arrive at their convenience. By implementing flexible cancellation policies as well, guests won’t feel the pressure to make a concrete decision so far in advance.

Fourth of July: A breakdown

That’s how the upcoming summer will look in general, but what about the season’s two main highlights? Let’s delve into the forecasted performance of Independence Day and the week leading up to it to see how it measures up to the rest of the summer and then look at how property managers can make the most of the upcoming celebrations!

ADR fireworks for Independence Day

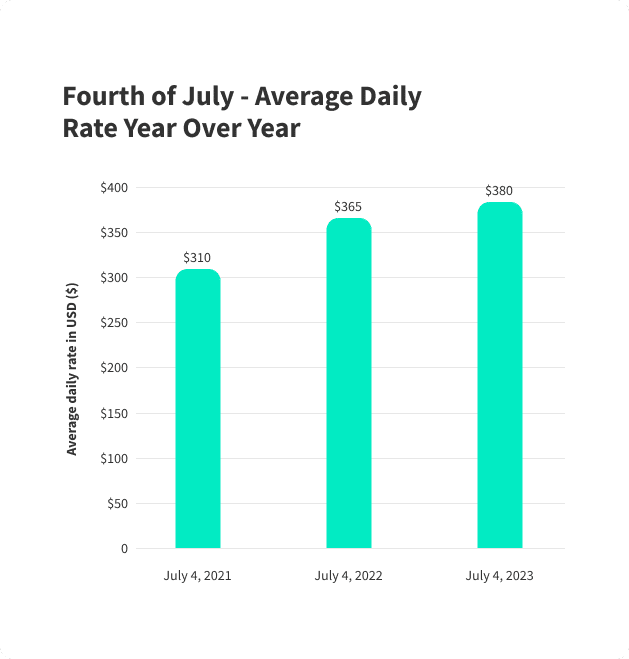

This year, we are seeing another hike in ADR, despite the summer’s overall drop. The average daily rate is $380 for June 27 to July 4, an increase of 4.6% from 2022 and 20.7% from 2021.

Why does July have higher rates this year?

Firstly, it’s worth noting that in 2021, July 4 fell on a Sunday, meaning Americans still only had the weekend to celebrate. In 2022, they were treated to an extended weekend as July 4 fell on a Monday, and this year, July 4 is a Tuesday, giving more people the opportunity to travel over the holiday. This increased travel activity leads to a higher demand for vacation rentals, driving up the prices.

Moreover, during the Fourth of July period, many people seek out beach destinations or areas with fireworks displays and other festive activities. These prime locations often have limited availability in terms of vacation rentals, creating a supply-demand imbalance that further pushes up the ADR.

Embrace the patriotic spirit

Consider adding or improving amenities that align with the Independence Day theme. This could include setting up an outdoor grill area, providing beach gear, or offering a fireworks viewing area.

You can even decorate your rental property with red, white, and blue accents, American flags, and festive decorations to create a lively and patriotic atmosphere. These added touches can make your property seem like the perfect Fourth of July destination.

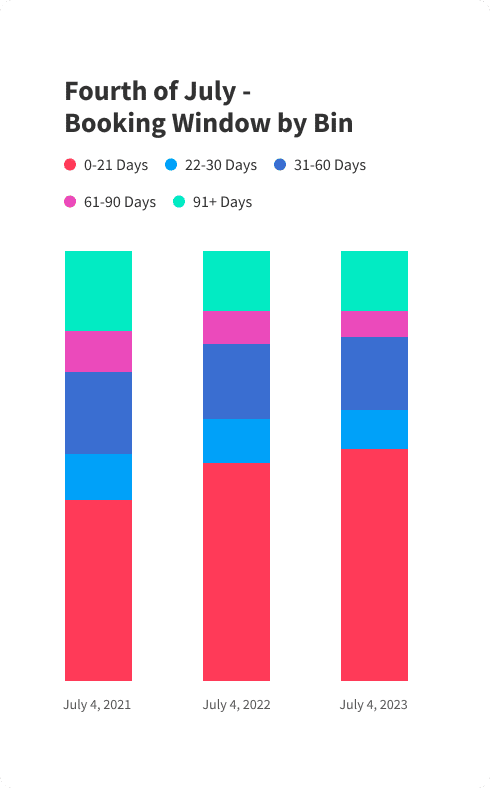

Last-minute bookings on the rise

In 2023, guests have left it longer to choose their Fourth of July destination. If we consider a ‘last-minute booking’ as a booking made between 0 and 21 days before the arrival date, then 56% of reservations for July 4 have been last minute. This is a 5% increase from the same period in 2022 and a 14% increase from 2021, as well as a higher rate of last-minute bookings compared to this year’s general summer total.

Why do guests leave it late to book when there’s high demand?

Guests may be waiting until the last minute to book because they want to see if better options become available or if prices drop as the date approaches. By waiting, they can also be more flexible in their travel plans and take advantage of any last-minute deals or discounts.

Promote last-minute deals

Create special offers or discounts specifically targeted at last-minute bookings for the Fourth of July period. Advertise these deals prominently on your website, social media channels, and listing platforms to catch the attention of potential guests.

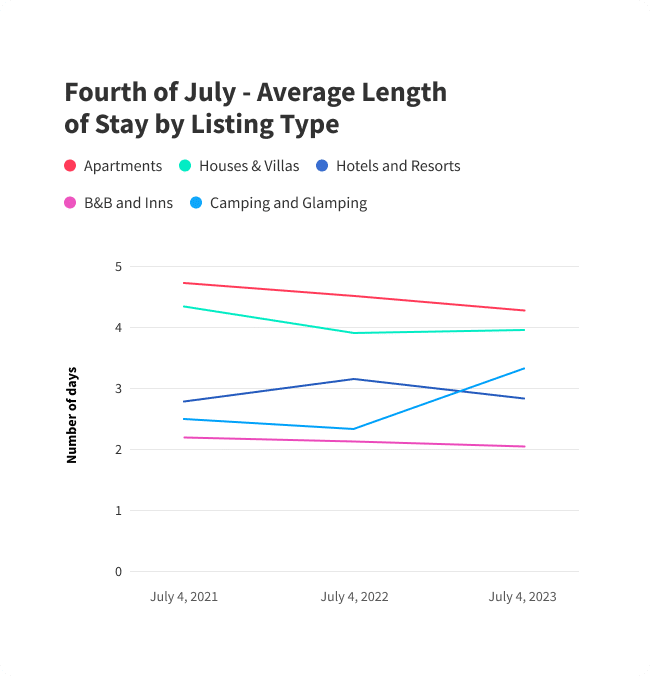

Glampers embrace longer stays

Despite being on a Tuesday, it looks like most Americans won’t take an extra day off for the Fourth of July. However, while most property types can expect a similar ALOS for the Fourth of July getaway compared to last year, one specific type of business is seeing a big boost in popularity. Good news for camping and glamping hosts—guests are staying an extra day this year.

The average length of stay for glamping and camping accommodations for last year’s Independence Day getaway was 2.3 days; however, this year’s average is 3.3 days, the largest increase out of Lodgify’s accommodation categories.

Why are people staying in their tents this year?

Well, camping and glamping accommodations traditionally have a much lower ADR than any other category, so the cheaper rates could be appealing to many guests. Also, the fact that Independence Day is on a Tuesday this year has perhaps led to guests booking the previous weekend as well.

On top of that, glamping is one of the fastest-growing niches within the short-term rental industry, meaning every year, there are higher-quality options to choose from.

Sell your star-spangled sky

Offer exclusive perks such as discounted rates for extended stays, barbecue kits, or organized outdoor activities like guided hikes or stargazing sessions. Make sure to highlight that your property is perfect for viewing the stars and fireworks.

If you’re thinking of starting a glamping business or simply want to learn more about the market, check out our free guide on everything glamping here.

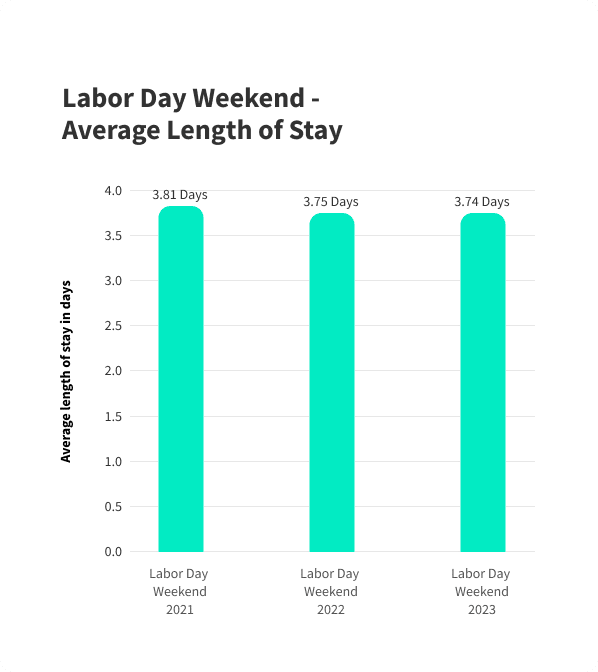

Labor Day Weekend: Early insights

As summer starts to come to an end, there is still one last chance of a sun-kissed getaway before bidding farewell to the season. Each year, it falls on the first Monday in September, however, for this report, we will be exploring the data for Labor Day Weekend.

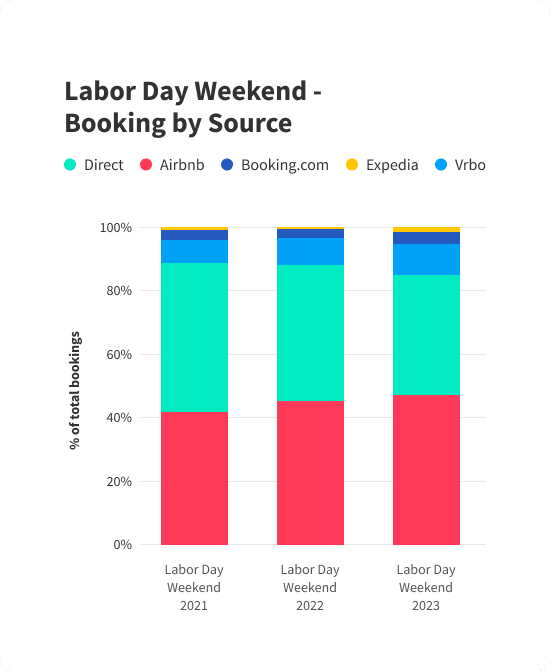

Airbnb’s ascendancy in Labor Day getaways

Although still over two months away, Airbnb is proving to be the top source of bookings for this year’s Labor Day Weekend (2-4 September). This represents a change compared to 2021, when direct bookings took 47% of the total booking share while Airbnb secured 42%.

Fast forward two years, and it appears the roles are reversing slightly, with Airbnb on course to take 47% of the total bookings and direct bookings making up 38%. However, direct bookings will still represent more than 1 out of every 3 bookings forecasted for the holiday, so keep both channels optimized.

Why has Airbnb caught up with direct bookings?

Looking at the graph above, we can see that since 2021, people have been booking shorter stays for Labor Day Weekend, with this year’s average at 3.74 days so far. People often turn to OTAs for reservations of less than 7 days, as mentioned previously, so it reflects the summer’s general trend here.

Use both channels to your advantage

Although Airbnb is taking in a larger share of Labor Day Weekend bookings than in previous years, direct bookings are still an essential source of bookings that shouldn’t be abandoned. To maximize your Labor Day earnings, you’ll want to ensure both channels are optimized and ready to accept reservations.

Connect your direct booking website with Airbnb through your PMS’ channel manager to synchronize your bookings, calendars, and rates while avoiding double bookings.

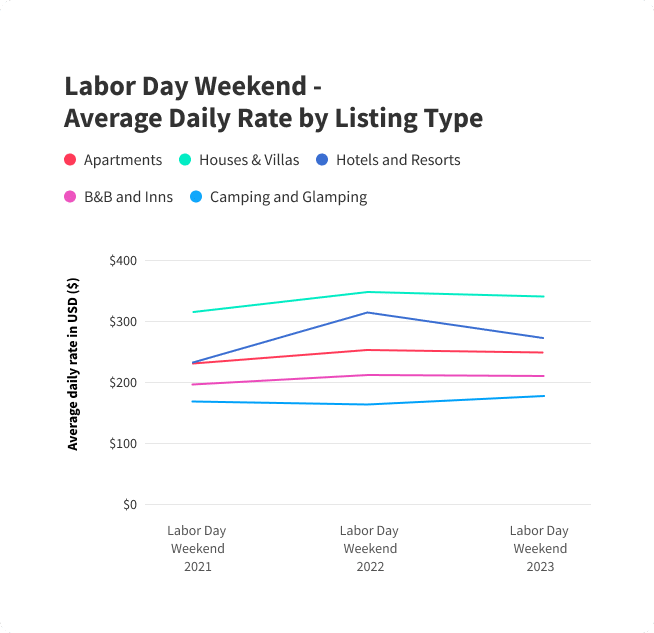

Labor Day sees discounted hotel rates

So far, we’re seeing that the ADR for hotels and resorts has plummeted by nearly 20% for this year’s Labor Day Weekend compared to 2022, the biggest drop out of all the accommodation categories. However, this trend is unlikely to stay this way.

Why are hotels getting so much cheaper this year?

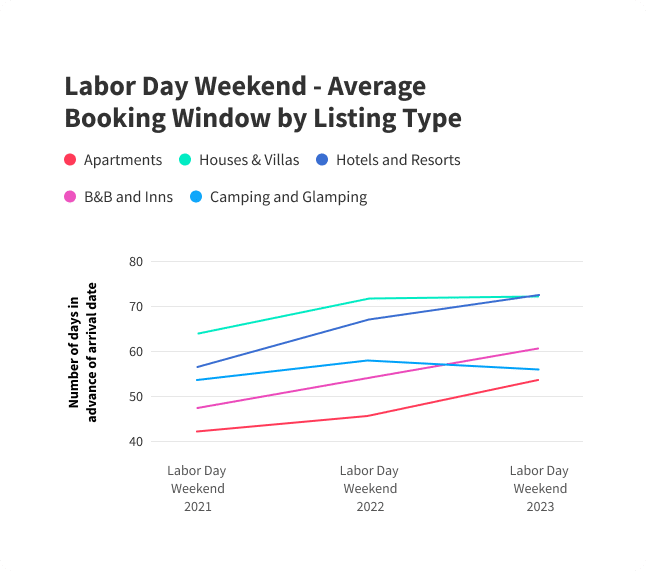

One of the potential reasons for this drop in ADR could be due to the increased booking window for hotels and resorts this year. Looking at the chart below, we can see that it has increased from 66 days in 2022 to 72 days in 2023. At the time of writing this report, Labor Day is 63 days away, meaning hotels have begun taking their bookings for Labor Day Weekend already.

It could be a sign that hotels and resorts are capitalizing on the early bookers by offering discounted rates to secure their reservations. It’s likely that the ADR will rise again as it gets closer to the time and demand for rentals increases.

Start thinking about your Labor Day rates now

It may seem far off still for some hosts, but the competition for Labor Day guests has already begun. Make sure your rates, including offers and discounts, are up to date as soon as possible, so you can start accepting bookings. Try integrating a dynamic pricing solution with your PMS, as this will help keep your prices competitive while making the most of any changes to ADR trends.

Key takeaways

Although vacation rental hosts may see a drop in occupancy and average daily rates this summer, there is a silver lining. Not only has the supply of vacation rentals increased, but so has demand, meaning more travelers than last year will be looking to book. This means there is still plenty of opportunity to have an even more successful 2023.

By adjusting your marketing strategy and being creative with your offers, you can target last-minute guests, guests who book longer stays, and niche customers. Furthermore, if you invest in a direct booking website and have it connected to your OTA listings, you can ensure you are as prepared as possible to take advantage of this summer’s booking trends.

Download the industry report below for all the latest data and insights at your fingertips!

Don’t see the form to download the Industry Report? Click here.

Methodology – How we created this report

We’ve analyzed more than 740,000 bookings within Lodgify’s internal data, including direct and OTA bookings, and compared specific data points with previous reports. We’ve gathered data on U.S. bookings created from January 1st, 2021, until June 30, 2023, for arrival dates up to December 31st, 2023. We also combined this data with specialized software to make forecasts based on current and previous trends.

For statistical purposes, we’ve also filtered out outliers that would have impacted the final results.